Question: hi this this the question Problem 1 Limit order trading model Consider a nite horizon [0, T], which is usually within one day. A stock

hi this this the question

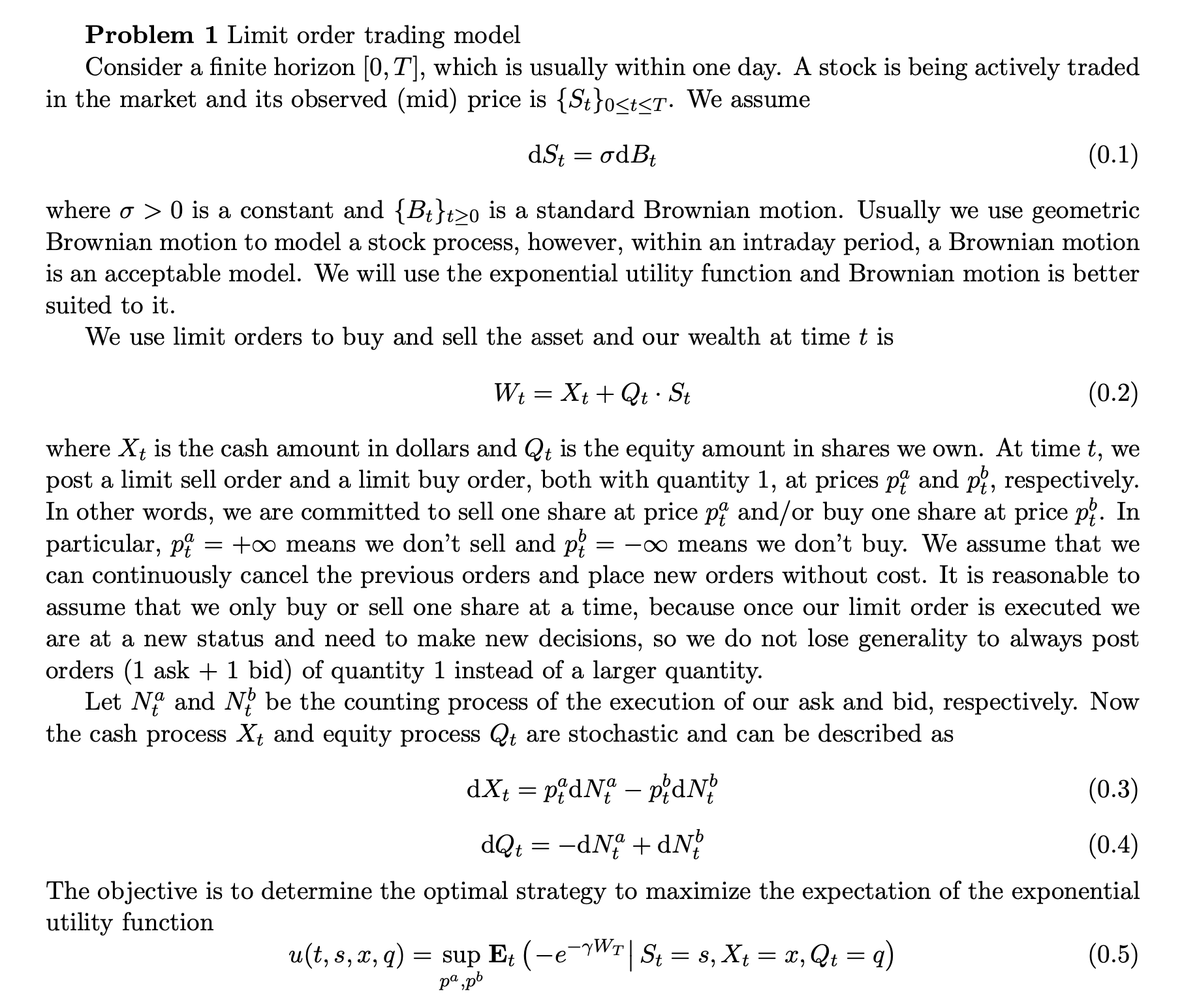

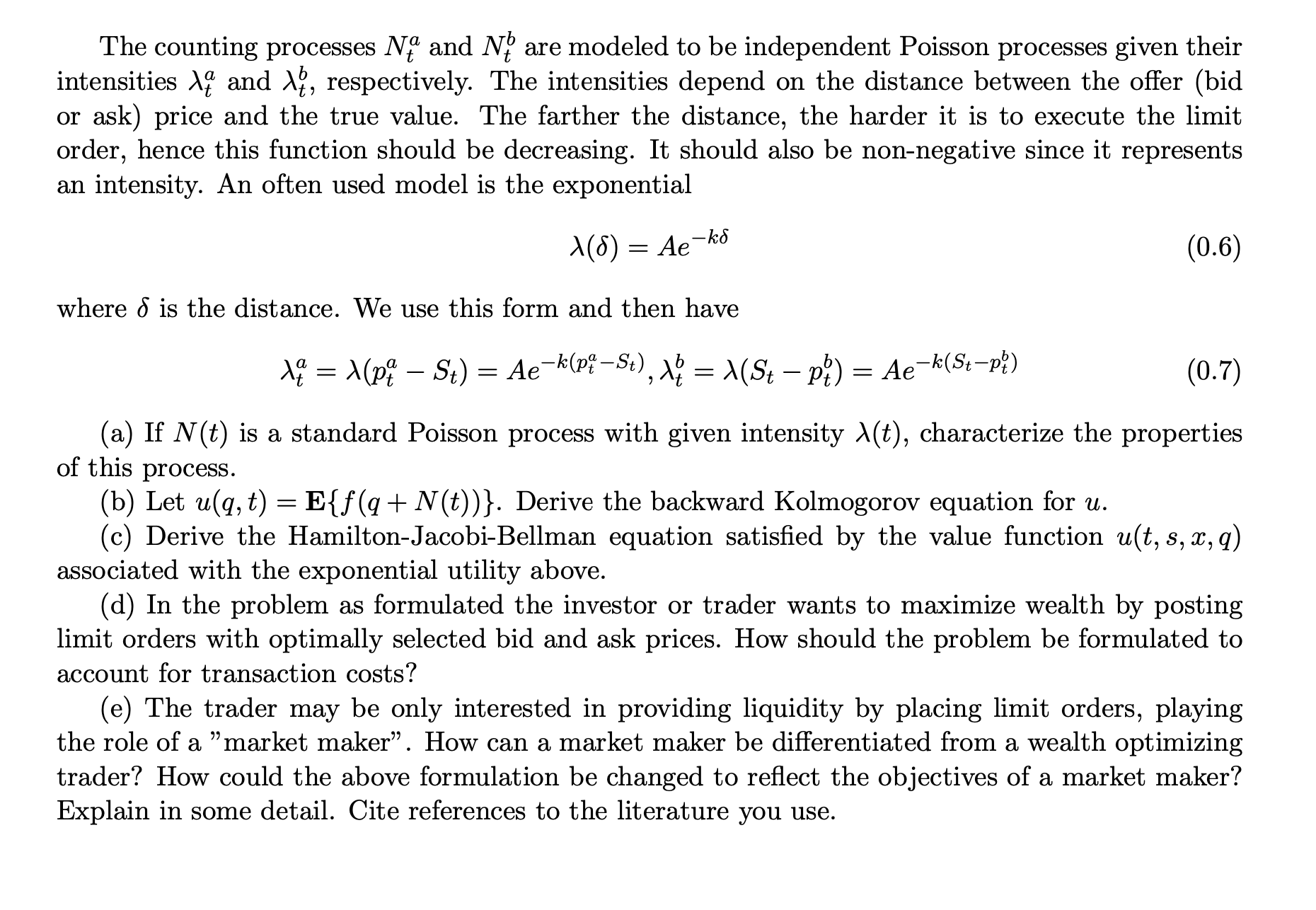

Problem 1 Limit order trading model Consider a nite horizon [0, T], which is usually within one day. A stock is being actively traded in the market and its observed (mid) price is {St}OStST. We assume as, = adB, (0.1) where 0 > 0 is a constant and {33,20 is a standard Browuian motion. Usually we use geometric Browuian motion to model a stock process, however, within an intraday period, a Brownian motion is an acceptable model. We will use the exponential utility function and Brownian motion is better suited to it. We use limit orders to buy and sell the asset and our wealth at time t is Wt : X13 + Qt ' St (0.2) where Xt is the cash amount in dollars and Qt is the equity amount in shares we own. At time t, we post a limit sell order and a limit buy order, both with quantity 1, at prices p? and pg, respectively. In other words, we are committed to sell one share at price p? and/ or buy one share at price pg. In particular, p? = +00 means we don't sell and p? 2 00 means we don't buy. We assume that we can continuously cancel the previous orders and place new orders without cost. It is reasonable to assume that we only buy or sell one share at a time, because once our limit order is executed we are at a new status and need to make new decisions, so we do not lose generality to always post orders (1 ask + 1 bid) of quantity 1 instead of a larger quantity. Let N,\" and Nib be the counting process of the execution of our ask and bid, respectively. Now the cash process X; and equity process Q, are stochastic and can be described as ax. =10:de p2dN (0.3) do, = dN,? + de (0.4) The objective is to determine the optimal strategy to maximize the expectation of the exponential utility function u(t, 3,33, q) : supb Et (e'lWTl St : s,Xt : :12, Q; = q) (0.5) pp The counting processes N5\" and N: are modeled to be independent Poisson processes given their intensities X; and Ag, respectively. The intensities depend on the distance between the offer (bid or ask) price and the true value. The farther the distance, the harder it is to execute the limit order, hence this function should be decreasing. It should also be non-negative since it represents an intensity. An often used model is the exponential ,\\(5) = Ae-M (0.6) where 5 is the distance. We use this form and then have A? = Mp? st) = Ate\"Pits\