Question: Hi tutor please answer 35 and 36.Please indicate lastly if tax amount is due to the irs or if it is a refund to Lenzos.Thank

Hi tutor please answer 35 and 36.Please indicate lastly if tax amount is due to the irs or if it is a refund to Lenzos.Thank you so much tutor!

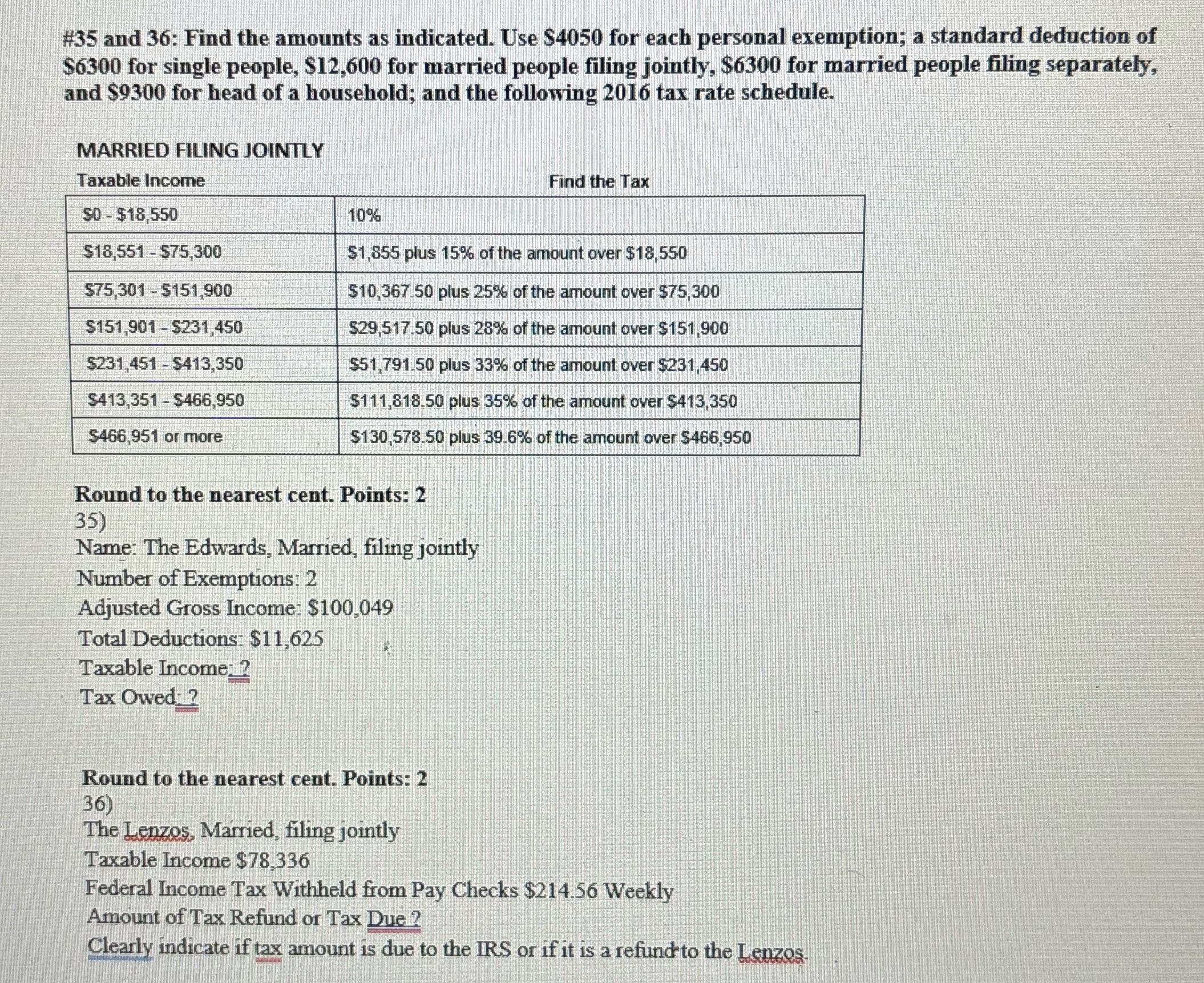

#35 and 36: Find the amounts as indicated. Use $4050 for each personal exemption; a standard deduction of $6300 for single people, $12,600 for married people filing jointly, $6300 for married people filing separately, and $9300 for head of a household; and the following 2016 tax rate schedule. MARRIED FILING JOINTLY Taxable Income Find the Tax SO - $18,550 10% $18,551 - 575,300 $1,855 plus 15% of the amount over $18,550 $75,301 - $151,900 $10,367.50 plus 25% of the amount over $75,300 $151,901 - $231,450 $29,517.50 plus 28% of the amount over $151,900 $231,451 - $413,350 $51,791.50 plus 33% of the amount over $231,450 $413,351 - $466,950 $111,818.50 plus 35% of the amount over $413,350 $466,951 or more $130,578.50 plus 39.6% of the amount over $466,950 Round to the nearest cent. Points: 2 35) Name: The Edwards, Married, filing jointly Number of Exemptions: 2 Adjusted Gross Income: $100,049 Total Deductions: $11,625 Taxable Income: ? Tax Owed: 2 Round to the nearest cent. Points: 2 36) The Lenzos, Married, filing jointly Taxable Income $78,336 Federal Income Tax Withheld from Pay Checks $214.56 Weekly Amount of Tax Refund or Tax Due ? Clearly indicate if tax amount is due to the IRS or if it is a refund to the Lenzos

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts