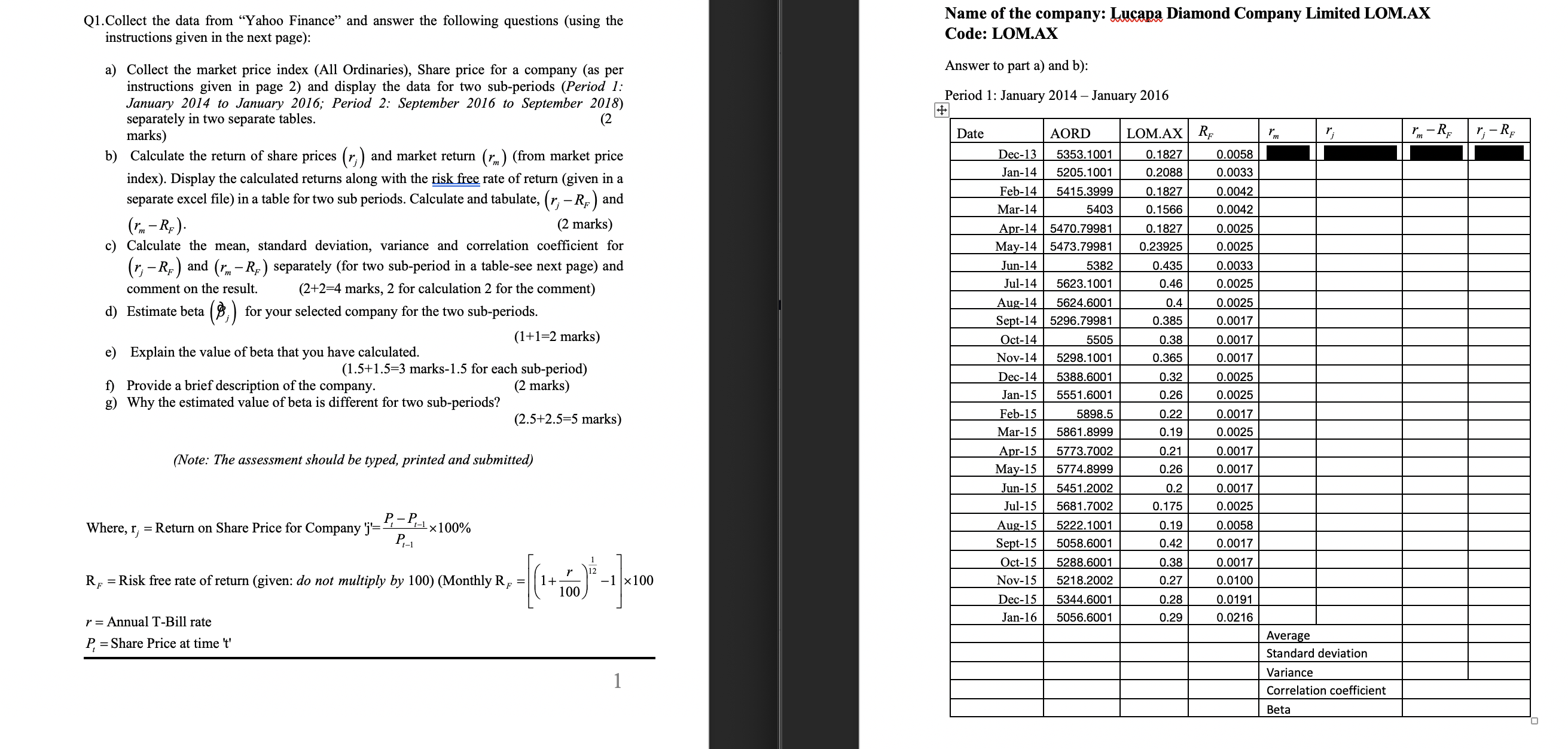

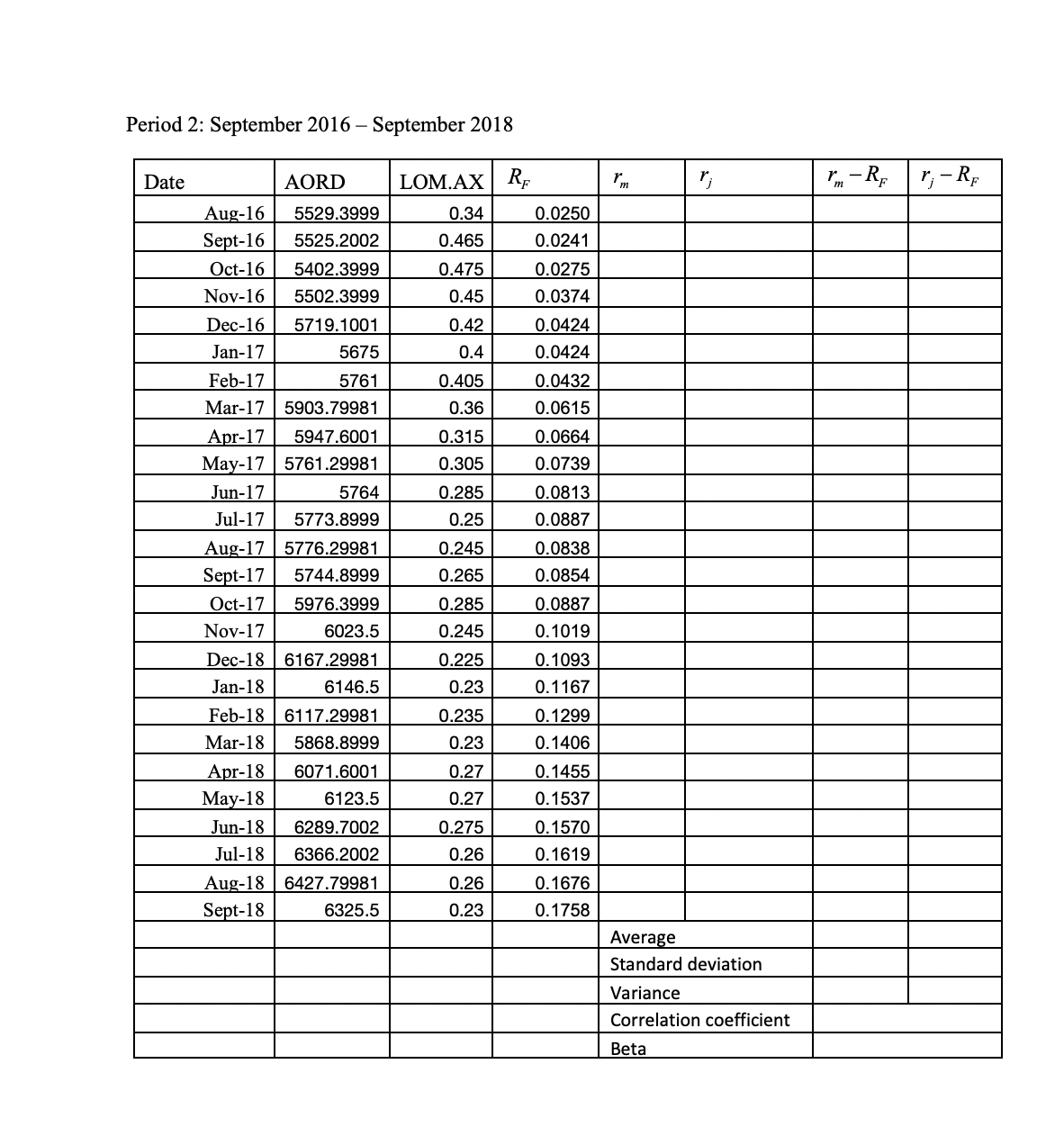

Question: Hi would you please be able to help me out with these following questions. Q1.Collect the data from Yahoo Finance and answer the following questions

Hi would you please be able to help me out with these following questions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock