Question: hich statement describes the difference between reports run on the Cash Basis and reports run on the Accrual Basis? A Accrual Basis reports show accrued

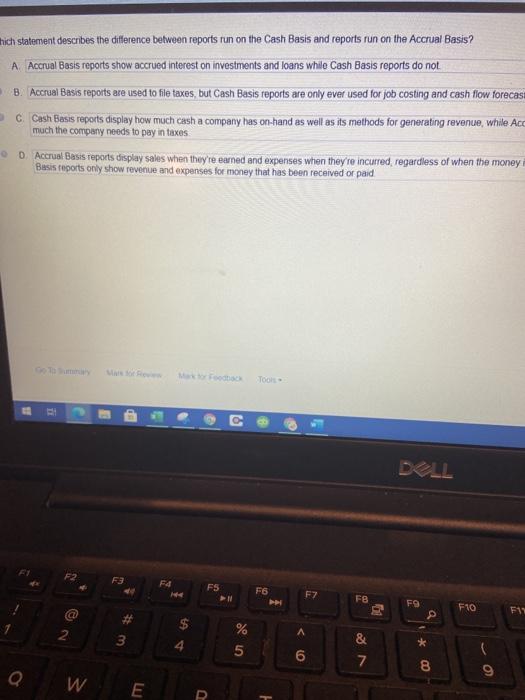

hich statement describes the difference between reports run on the Cash Basis and reports run on the Accrual Basis? A Accrual Basis reports show accrued interest on investments and loans while Cash Basis reports do not B. Accrual Basis reports are used to file taxes, but Cash Basis reports are only ever used for job costing and cash flow forecas C Cash Basis reports display how much cash a company has on-hand as well as its methods for generating revenue, while Acc much the company needs to pay in taxes . Accrual Basis reports display sales when they're earned and expenses when they're incurred, regardless of when the money Basis reports only show revenue and expenses for money that has been received or paid C DOLL F3 F4 FS F7 FB FO F10 3 @ # a F11 2 $ 4 3 % 5 * 6 & 7 8 9 W E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts