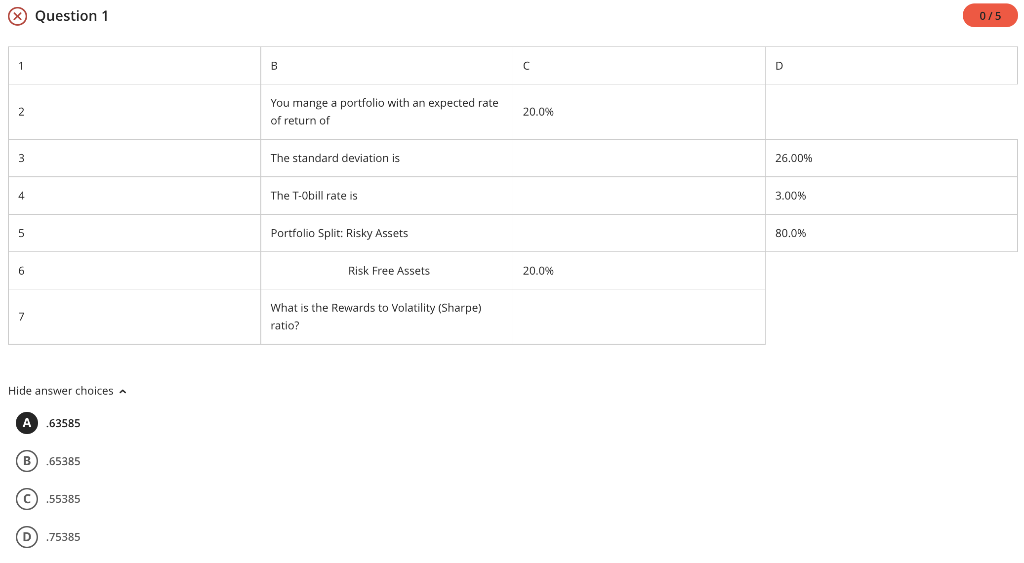

Question: Hide answer choices .63585 .65385 .55385 .75385 @ Question 1 You mange a portfolio with an expected rate of return of -rhe standard deviation is

Hide answer choices .63585 .65385 .55385 .75385

@ Question 1 You mange a portfolio with an expected rate of return of -rhe standard deviation is The T-ObiII rate is Portfolio Split: Risky Assets Risk Free Assets What is the Rewards to Volatility (Sharpe) ratio? Hide answer choices 20.0% 20.0% 26.00% 3.00% 80.0% o B c D .63585 *65385 155385 75385

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts