Question: High End short term rentals: Task Steps: Identify Key Financial Data: Extract the following key financial data from the provided dataset: Total Yearly costs including

High End short term rentals:

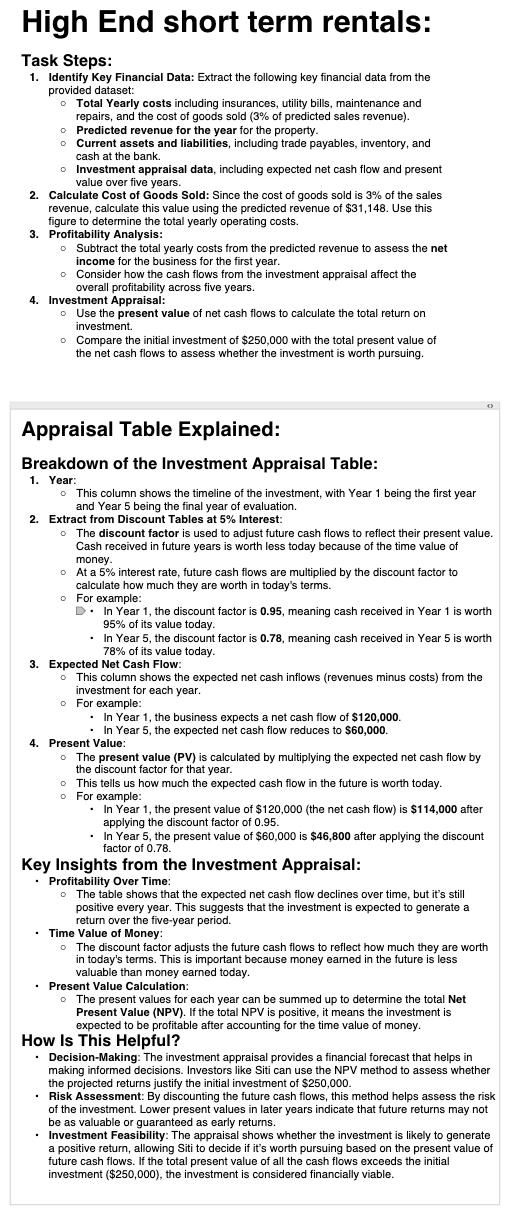

Task Steps:

Identify Key Financial Data: Extract the following key financial data from the

provided dataset:

Total Yearly costs including insurances, utility bills, maintenance and

repairs, and the cost of goods sold of predicted sales revenue

Predicted revenue for the year for the property.

Current assets and liabilities, including trade payables, inventory, and

cash at the bank.

Investment appraisal data, including expected net cash flow and present

value over five years.

Calculate Cost of Goods Sold: Since the cost of goods sold is of the sales

revenue, calculate this value using the predicted revenue of $ Use this

figure to determine the total yearly operating costs.

Profitability Analysis:

Subtract the total yearly costs from the predicted revenue to assess the net

income for the business for the first year.

Consider how the cash flows from the investment appraisal affect the

overall profitability across five years.

Investment Appraisal:

Use the present value of net cash flows to calculate the total return on

investment.

Compare the initial investment of $ with the total present value of

the net cash flows to assess whether the investment is worth pursuing.

Appraisal Table Explained:

Breakdown of the Investment Appraisal Table:

Year:

This column shows the timeline of the investment, with Year being the first year

and Year being the final year of evaluation.

Extract from Discount Tables at Interest:

The discount factor is used to adjust future cash flows to reflect their present value.

Cash received in future years is worth less today because of the time value of

money.

At a interest rate, future cash flows are multiplied by the discount factor to

calculate how much they are worth in today's terms.

For example:

D In Year the discount factor is meaning cash received in Year is worth

of its value today.

In Year the discount factor is meaning cash received in Year is worth

of its value today.

Expected Net Cash Flow:

This column shows the expected net cash inflows revenues minus costs from the

investment for each year.

For example:

In Year the business expects a net cash flow of $

In Year the expected net cash flow reduces to $

Present Value:

The present value PV is calculated by multiplying the expected net cash flow by

the discount factor for that year.

This tells us how much the expected cash flow in the future is worth today.

For example:

In Year the present value of $the net cash flow is $ after

applying the discount factor of

In Year the present value of $ is $ after applying the discount

factor of

Key Insights from the Investment Appraisal:

Profitability Over Time:

The table shows that the expected net cash flow declines over time, but it's still

positive every year. This suggests that the investment is expected to generate a

return over the fiveyear period.

Time Value of Money:

The discount factor adjusts the future cash flows to reflect how much they are worth

in today's terms. This is important because money earned in the future is less

valuable than money earned today.

Present Value Calculation:

The present values for each year can be summed up to determine the total Net

Present Value NPV If the total NPV is positive, it means the investment is

expected to be profitable after accounting for the time value of money.

How Is This Helpful?

DecisionMaking: The investment appraisal provides a financial forecast that helps in

making informed decisions. Investors like Siti can use the NPV method to assess whether

the projected returns justify the initial investment of $

Risk Assessment: By discounting the future cash flows, this method helps assess the risk

of the investment. Lower present values in later years indicate that future returns may not

be as valuable or guaranteed as early returns.

Investment Feasibility: The appraisal shows whether the investment is likely to generate

a positive return, allowing Siti to decide if it's worth pursuing based on the present value of

future cash flows. If the total present value of all the cash flows exceeds the initial

investment

$ the investment is considered financially viable.

High End short term rentals:

Task Steps:

Identify Key Financial Data: Extract the following key financial data from the

provided dataset:

Total Yearly costs including insurances, utility bills, maintenance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock