Question: High Life, Inc.'s inventory records for a particular development program show the following at January 31 EEB Click the icon to view the accounting records.)

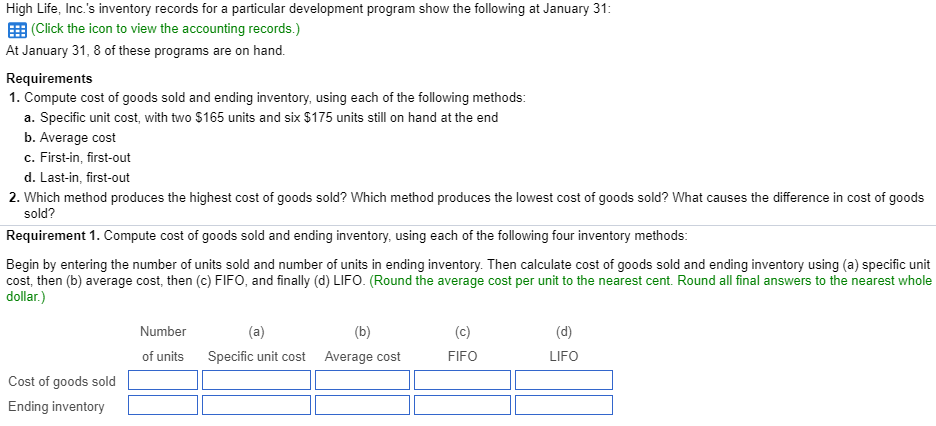

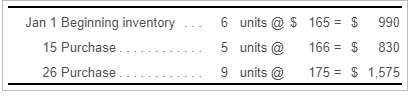

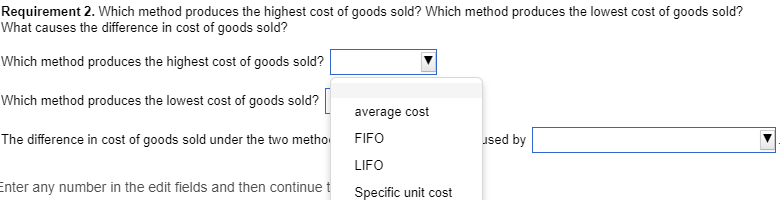

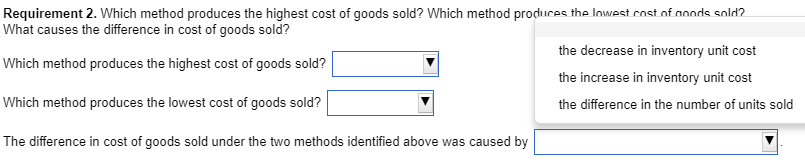

High Life, Inc.'s inventory records for a particular development program show the following at January 31 EEB Click the icon to view the accounting records.) At January 31, 8 of these programs are on hand. Requirements 1. Compute cost of goods sold and ending inventory, using each of the following methods a. Specific unit cost, with two $165 units and six $175 units still on hand at the end b. Average cost c. First-in, first-out d. Last-in, first-out 2. Which method produces the highest cost of goods sold? Which method produces the lowest cost of goods sold? What causes the difference in cost of goods sold? Requirement 1. Compute cost of goods sold and ending inventory, using each of the following four inventory methods Begin by entering the number of units sold and number of units in ending inventory. Then calculate cost of goods sold and ending inventory using (a) specific unit cost, then (b) average cost, then (c) FIFO, and finally (d) LIFO. (Round the average cost per unit to the nearest cent. Round al final answers to the nearest whole dollar.) Number of units Specific unit cost Average cost FIFO LIFO Cost of goods sold Ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts