Question: High - Variance Margin Buying and Short Selling ( 4 5 points ) You are given the following information for two assets, one stock that

HighVariance Margin Buying and Short Selling points You are given the following information for two assets, one stock that is only available for purchase on margin long and another only available to short sell. Assume for each asset, a separate coin is flipped exactly one year from today and either the happy or sad state of the world is realized. Additional Information: The initial margin requirement IMR for both stocks is The maintenance margin requirement MMR for the Long Stock is and the Short Stock is In both cases you will always begin by borrowing the maximum allowed and we will assume any transaction, long or short, is for exactly shares. Question : points For each stock, show whether the happy state andor the sad state of the world will result in a margin call. Justify your answer by calculating the relevant thresholds. Hint: there are four possible stockstate combinations, but you may not have to calculate four thresholds HighVariance Margin Buying and Short Selling points

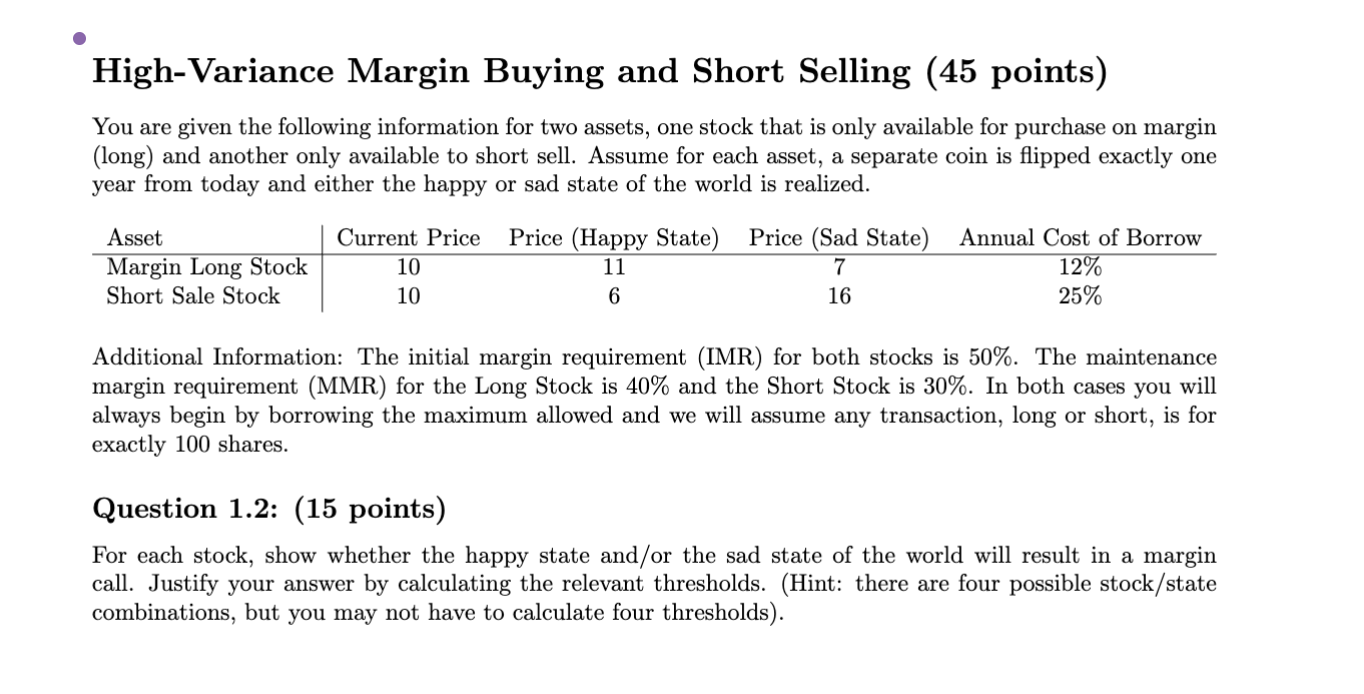

You are given the following information for two assets, one stock that is only available for purchase on margin long and another only available to short sell. Assume for each asset, a separate coin is flipped exactly one year from today and either the happy or sad state of the world is realized.

Additional Information: The initial margin requirement IMR for both stocks is The maintenance margin requirement MMR for the Long Stock is and the Short Stock is In both cases you will always begin by borrowing the maximum allowed and we will assume any transaction, long or short, is for exactly shares.

Question : points

For each stock, show whether the happy state andor the sad state of the world will result in a margin call. Justify your answer by calculating the relevant thresholds. Hint: there are four possible stockstate combinations, but you may not have to calculate four thresholds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock