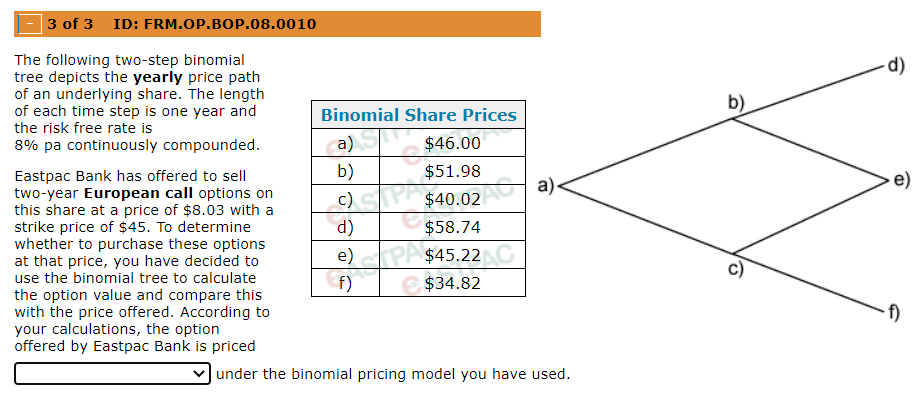

Question: Higher than it is valued/ Lower than it is valued/ correctly 3 of 3 ID: FRM.OP.BOP.08.0010 d) b) e) The following two-step binomial tree depicts

Higher than it is valued/ Lower than it is valued/ correctly

3 of 3 ID: FRM.OP.BOP.08.0010 d) b) e) The following two-step binomial tree depicts the yearly price path of an underlying share. The length of each time step is one year and Binomial Share Prices the risk free rate is 8% pa continuously compounded. $46.00 Eastpac Bank has offered to sell b) $51.98 two-year European call options on a) c) this share at a price of $8.03 with a $40.02 strike price of $45. To determine d) $58.74 whether to purchase these options at that price, you have decided to e) $45.22 use the binomial tree to calculate f) $34.82 the option value and compare this with the price offered. According to your calculations, the option offered by Eastpac Bank is priced under the binomial pricing model you have used. c) f)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts