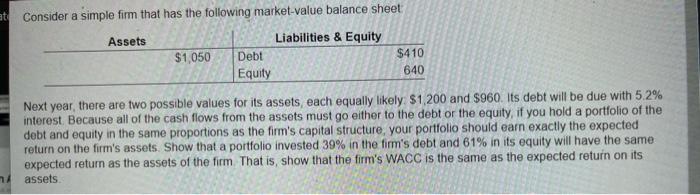

Question: Highlight each answer and in bold et Consider a simple firm that has the following market value balance sheet Assets $1,050 Liabilities & Equity Debt

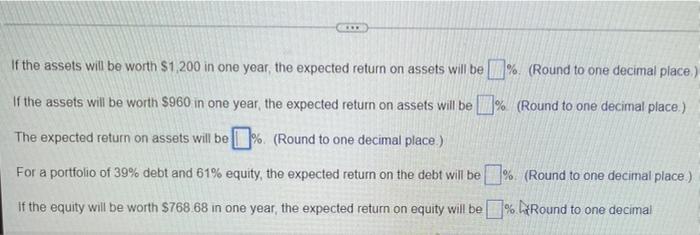

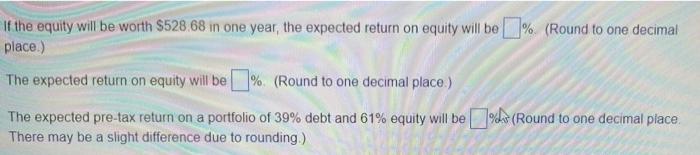

et Consider a simple firm that has the following market value balance sheet Assets $1,050 Liabilities & Equity Debt Equity $410 640 Next year, there are two possible values for its assets, each equally likely $1,200 and $960. Its debt will be due with 5.2% interest Because all of the cash flows from the assets must go either to the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm's capital structure, your portfolio should earn exactly the expected return on the firm's assets. Show that a portfolio invested 39% in the firm's debt and 61% in its equity will have the same expected return as the assets of the firm That is, show that the firm's WACC is the same as the expected return on its m assets RO If the assets will be worth $1,200 in one year, the expected return on assets will be % (Round to one decimal place) If the assets will be worth $960 in one year, the expected return on assets will be 1% (Round to one decimal place.) The expected return on assets will be % (Round to one decimal place.) For a portfolio of 39% debt and 61% equity, the expected return on the debt will be % (Round to one decimal place.) if the equity will be worth $768 68 in one year, the expected return on equity will be % btRound to one decimal If the equity will be worth $528.68 in one year, the expected return on equity will be % (Round to one decimal place.) The expected return on equity will be % (Round to one decimal place.) The expected pre-tax return on a portfolio of 39% debt and 61% equity will be % (Round to one decimal place. There may be a slight difference due to rounding)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts