Question: High-Low method - Calculation of variable cost per unit High-Low method - Calculation of fixed costs Total cost at the high point Variable costs at

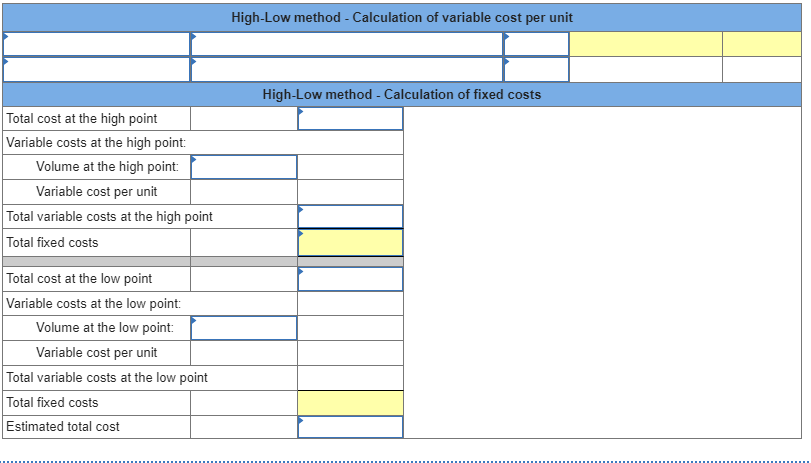

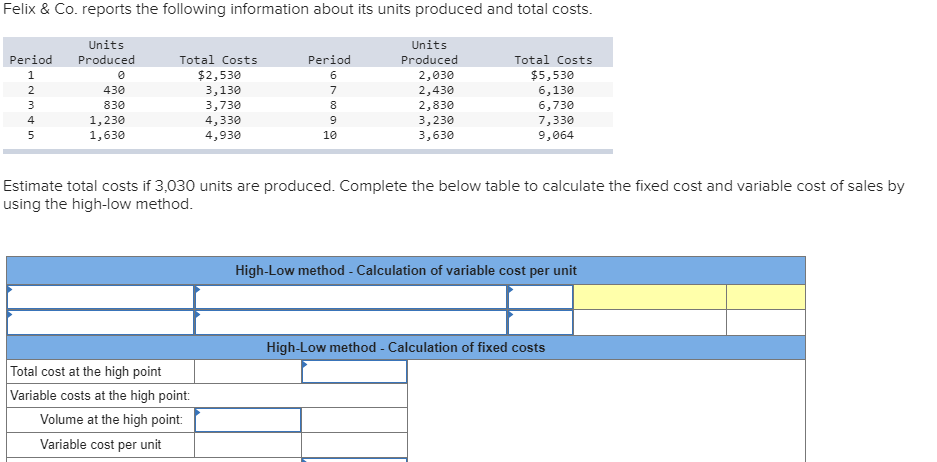

High-Low method - Calculation of variable cost per unit High-Low method - Calculation of fixed costs Total cost at the high point Variable costs at the high point: Volume at the high point: Variable cost per unit Total variable costs at the high point Total fixed costs Total cost at the low point Variable costs at the low point: Volume at the low point: Variable cost per unit Total variable costs at the low point Total fixed costs Estimated total cost Felix & Co. reports the following information about its units produced and total costs. Period Units Produced Period 430 Total Costs $2,530 3,130 3,730 4,330 4,930 OO. Units Produced 2,030 2,430 2,830 3,230 3,630 830 1,230 1,630 Total Costs $5,530 6,130 6,730 7,330 9,064 Estimate total costs if 3,030 units are produced. Complete the below table to calculate the fixed cost and variable cost of sales by using the high-low method. High-Low method - Calculation of variable cost per unit High-Low method - Calculation of fixed costs Total cost at the high point Variable costs at the high point: Volume at the high point Variable cost per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts