Question: Hill Enterprises wants to replace two old assembly machines with one new, more efficient assembly machine. The old machines are valued at $57,000 each. The

Hill Enterprises wants to replace two old assembly machines with one new, more efficient assembly machine. The old machines are valued at $57,000 each. The new machine will cost $100,000. If Hills controllable margin is $158,000 and their operating assets were valued at $600,000 before they bought the new machine, what will their new ROI be?

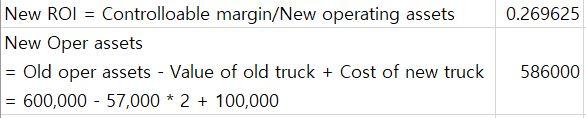

The answer is 26.64%. I want to know how to get this answer, because I got a wrong answer which is 26.96%. (below is my wrong answer)

\begin{tabular}{l|l} New ROI = Controlloable margin/New operating assets & 0.269625 \\ New Oper assets \\ = Old oper assets - Value of old truck + Cost of new truck & 586000 \\ =600,00057,0002+100,000 & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts