Question: Hillary Hawk has been divorced for some time and has sole custody of her two children, Mark and Mandy. Mark is 13 and Mandy

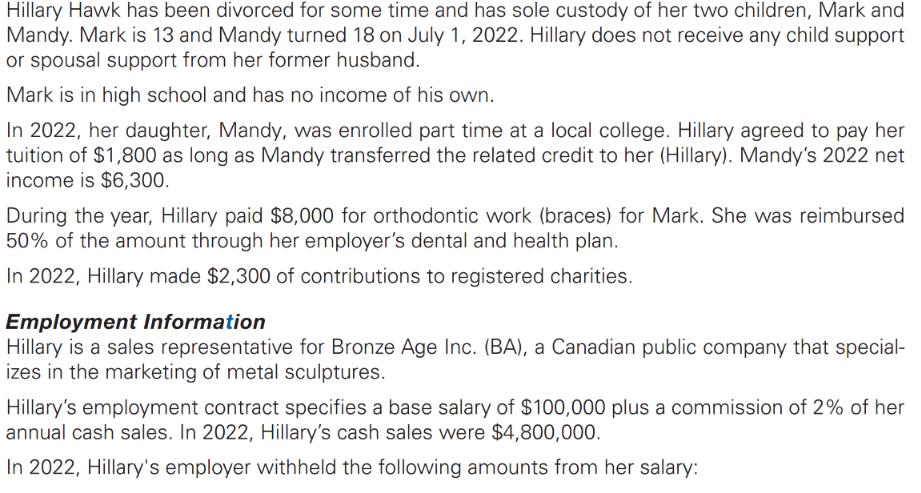

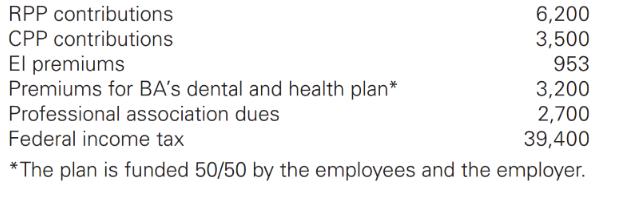

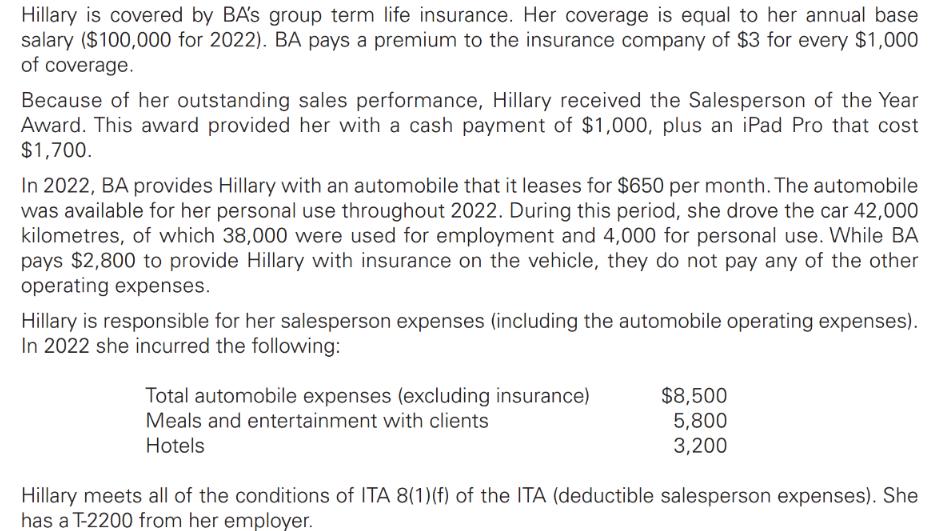

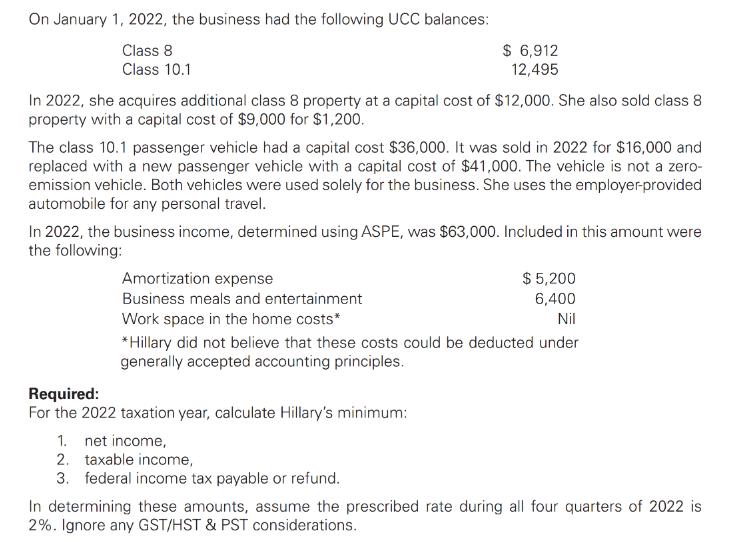

Hillary Hawk has been divorced for some time and has sole custody of her two children, Mark and Mandy. Mark is 13 and Mandy turned 18 on July 1, 2022. Hillary does not receive any child support or spousal support from her former husband. Mark is in high school and has no income of his own. In 2022, her daughter, Mandy, was enrolled part time at a local college. Hillary agreed to pay her tuition of $1,800 as long as Mandy transferred the related credit to her (Hillary). Mandy's 2022 net income is $6,300. During the year, Hillary paid $8,000 for orthodontic work (braces) for Mark. She was reimbursed 50% of the amount through her employer's dental and health plan. In 2022, Hillary made $2,300 of contributions to registered charities. Employment Information Hillary is a sales representative for Bronze Age Inc. (BA), a Canadian public company that special- izes in the marketing of metal sculptures. Hillary's employment contract specifies a base salary of $100,000 plus a commission of 2% of her annual cash sales. In 2022, Hillary's cash sales were $4,800,000. In 2022, Hillary's employer withheld the following amounts from her salary: RPP contributions CPP contributions El premiums 6,200 3,500 953 Premiums for BA's dental and health plan* Professional association dues Federal income tax *The plan is funded 50/50 by the employees and the employer. 3,200 2,700 39,400 Hillary is covered by BA's group term life insurance. Her coverage is equal to her annual base salary ($100,000 for 2022). BA pays a premium to the insurance company of $3 for every $1,000 of coverage. Because of her outstanding sales performance, Hillary received the Salesperson of the Year Award. This award provided her with a cash payment of $1,000, plus an iPad Pro that cost $1,700. In 2022, BA provides Hillary with an automobile that it leases for $650 per month. The automobile was available for her personal use throughout 2022. During this period, she drove the car 42,000 kilometres, of which 38,000 were used for employment and 4,000 for personal use. While BA pays $2,800 to provide Hillary with insurance on the vehicle, they do not pay any of the other operating expenses. Hillary is responsible for her salesperson expenses (including the automobile operating expenses). In 2022 she incurred the following: Total automobile expenses (excluding insurance) Meals and entertainment with clients Hotels $8,500 5,800 3,200 Hillary meets all of the conditions of ITA 8(1)(f) of the ITA (deductible salesperson expenses). She has a T-2200 from her employer. All utilities Property taxes Maintenance Home internet service Insurance on her home. Mortgage interest $4,200 6,500 2,400 900 2,100 11,500 Hillary estimates only 10% of the internet use was for her business because her children stream a lot of entertainment on a variety of devices. She does not claim CCA on her home as she realizes that if she did, this would result in future recapture and capital gains implications. On January 1, 2022, the business had the following UCC balances: Class 8 Class 10.1 In 2022, she acquires additional class 8 property at a capital cost of $12,000. She also sold class 8 property with a capital cost of $9,000 for $1,200. The class 10.1 passenger vehicle had a capital cost $36,000. It was sold in 2022 for $16,000 and replaced with a new passenger vehicle with a capital cost of $41,000. The vehicle is not a zero- emission vehicle. Both vehicles were used solely for the business. She uses the employer-provided automobile for any personal travel. $ 6,912 12,495 In 2022, the business income, determined using ASPE, was $63,000. Included in this amount were the following: Amortization expense Business meals and entertainment Work space in the home costs* $ 5,200 6,400 Nil *Hillary did not believe that these costs could be deducted under generally accepted accounting principles. Required: For the 2022 taxation year, calculate Hillary's minimum: 1. net income, 2. taxable income, 3. federal income tax payable or refund. In determining these amounts, assume the prescribed rate during all four quarters of 2022 is 2%. Ignore any GST/HST & PST considerations.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

To calculate Hillarys minimum net income taxable income and federal income tax payable or refund for the 2022 taxation year well need to go through various components of her financial situation and ap... View full answer

Get step-by-step solutions from verified subject matter experts