Question: Hint: 1. Enter and on Excel spreadsheet. 2. Set the mean return on the portfolio p at a required rate, say = 0.02 3. Enter

Hint: 1. Enter and on Excel spreadsheet.

Hint: 1. Enter and on Excel spreadsheet.

2. Set the mean return on the portfolio p at a required rate, say = 0.02

3. Enter some initial values for the portfolio weights on A, B, C, D, and E assets.

4. Calculate the variance of portfolio returns 2 p accordingly based on Step 1 & 3.

5. Calculate the standard deviation p of portfolio returns based on Step 4.

6. Calculate mean return on the portfolio p accordingly based on Step 2 & 3.

7. Activate Solver (from Data), if Solver is not installed, you can find and install it from Add-ins in Insert.

8. In setting the Solver parameters, type in the cell address of p in Set Objective window.

9. Type in the cell addresses for the portfolio weights set in Step 3 in By Changing Variable Cells window.

10. Add the constraint (using cell address in Subject to the Constraints window): p in Step 6 = in Step 2.

11. Click Solve tab and the optimization will be done by replacing the cells for portfolio weights in Step 3.

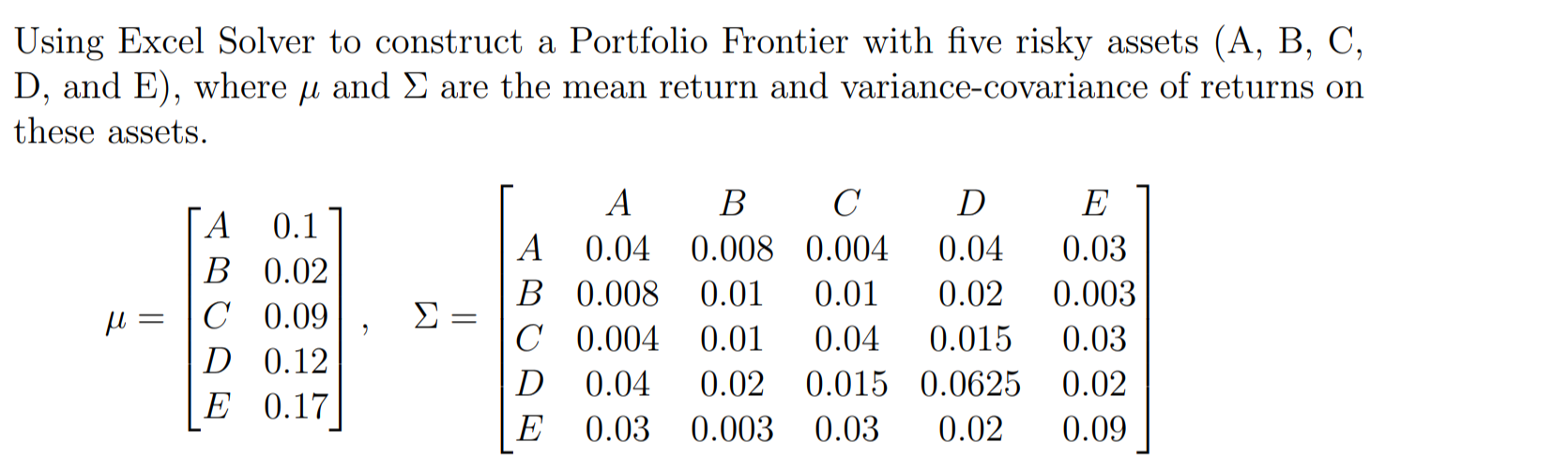

Using Excel Solver to construct a Portfolio Frontier with five risky assets (A, B, C, D, and E), where u and are the mean return and variance-covariance of returns on these assets. u= CA 0.17 B 0.02 C 0.09, D 0.12 LE 0.17] A B C D E A B C D 0.04 0.008 0.004 0.04 0.008 0.01 0.01 0.02 0.004 0.01 0.04 0.015 0.04 0.02 0.015 0.0625 0.03 0.003 0.03 0.02 E 7 0.03 0.003 0.03 0.02 0.09 Using Excel Solver to construct a Portfolio Frontier with five risky assets (A, B, C, D, and E), where u and are the mean return and variance-covariance of returns on these assets. u= CA 0.17 B 0.02 C 0.09, D 0.12 LE 0.17] A B C D E A B C D 0.04 0.008 0.004 0.04 0.008 0.01 0.01 0.02 0.004 0.01 0.04 0.015 0.04 0.02 0.015 0.0625 0.03 0.003 0.03 0.02 E 7 0.03 0.003 0.03 0.02 0.09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts