Question: Hint: Draw the timeline, plot the given rates to the corresponding intervals and calculate the forward rate for the blank interval 2. Compare and contrast

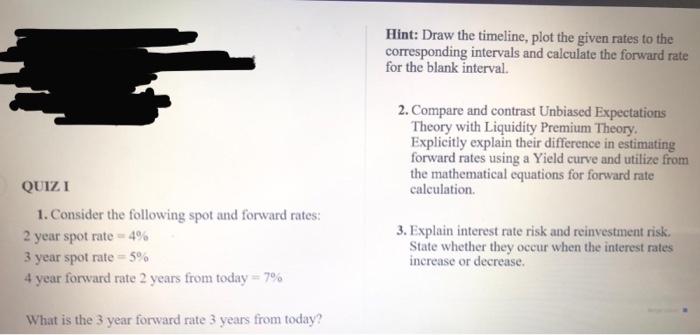

Hint: Draw the timeline, plot the given rates to the corresponding intervals and calculate the forward rate for the blank interval 2. Compare and contrast Unbiased Expectations Theory with Liquidity Premium Theory, Explicitly explain their difference in estimating forward rates using a Yield curve and utilize from the mathematical equations for forward rate calculation QUIZI 1. Consider the following spot and forward rates: 2 year spot rate 4% 3 year spot rate = 5% 4 year forward rate 2 years from today = 7% 3. Explain interest rate risk and reinvestm risk. State whether they occur when the interest rates increase or decrease. What is the 3 year forward rate 3 years from today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts