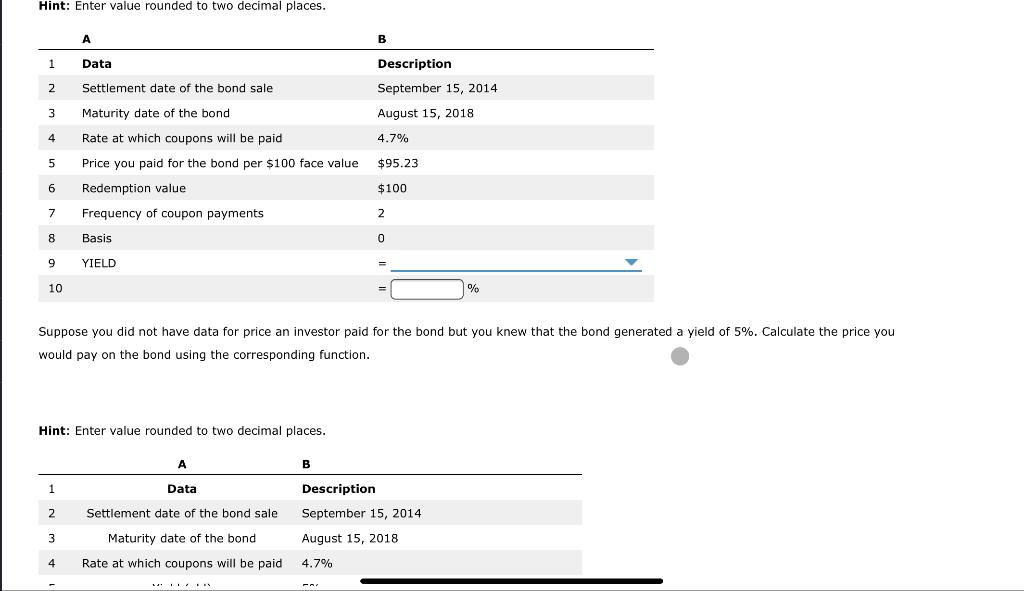

Question: Hint: Enter value rounded to two decimal places. A B 1 Data 2 Settlement date of the bond sale Description September 15, 2014 August 15,

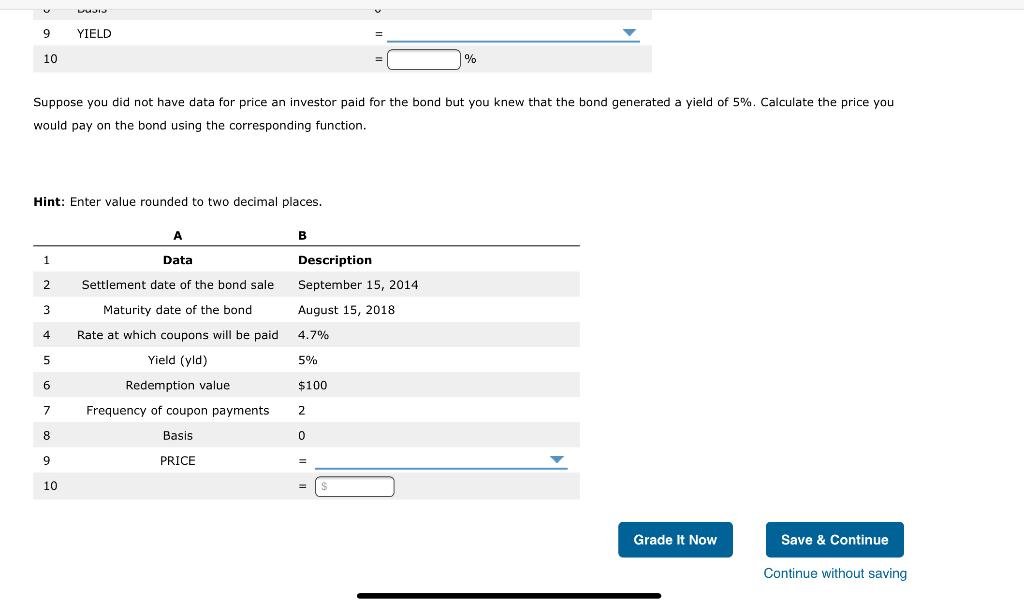

Hint: Enter value rounded to two decimal places. A B 1 Data 2 Settlement date of the bond sale Description September 15, 2014 August 15, 2018 3 Maturity date of the bond 4 Rate at which coupons will be paid 4.7% 5 Price you paid for the bond per $100 face value $95.23 6 Redemption value $100 7 Frequency of coupon payments 2 8 Basis 0 9 YIELD 10 Suppose you did not have data for price an investor paid for the bond but you knew that the bond generated a yield of 5%. Calculate the price you would pay on the bond using the corresponding function. Hint: Enter value rounded to two decimal places. B 1 Data Description 2 Settlement date of the bond sale 3 Maturity date of the bond September 15, 2014 August 15, 2018 4.7% 4 Rate at which coupons will be paid 9 YIELD 10 % Suppose you did not have data for price an investor paid for the bond but you knew that the bond generated a yield of 5%. Calculate the price you would pay on the bond using the corresponding function. Hint: Enter value rounded to two decimal places. A B 1 Data Description 2 Settlement date of the bond sale September 15, 2014 3 Maturity date of the bond August 15, 2018 4.7% 4 Rate at which coupons will be paid Yield (yld) 5 5% 6 $100 7 Redemption value Frequency of coupon payments Basis 2 8 0 9 PRICE = 10 Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts