Question: Hippo Drones plans to make a new drone model available for purchase. In order to launch the project, the company is planning to accumulate excess

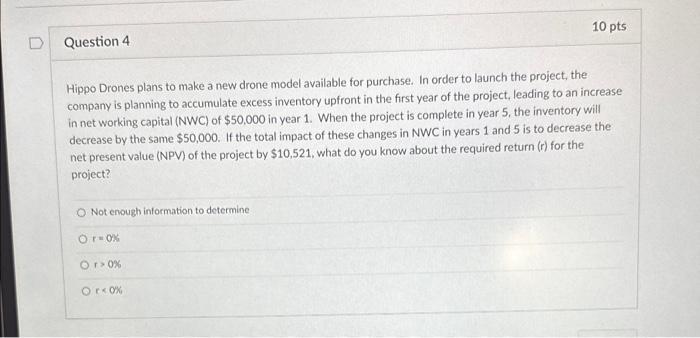

Hippo Drones plans to make a new drone model available for purchase. In order to launch the project, the company is planning to accumulate excess inventory upfront in the first year of the project, leading to an increase in net working capital (NWC) of $50,000 in year 1 . When the project is complete in year 5 , the inventory will decrease by the same $50,000. If the total impact of these changes in NWC in years 1 and 5 is to decrease the net present value (NPV) of the project by $10,521, what do you know about the required return (r) for the project? Not enough information to determine r=0% r>0% r

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts