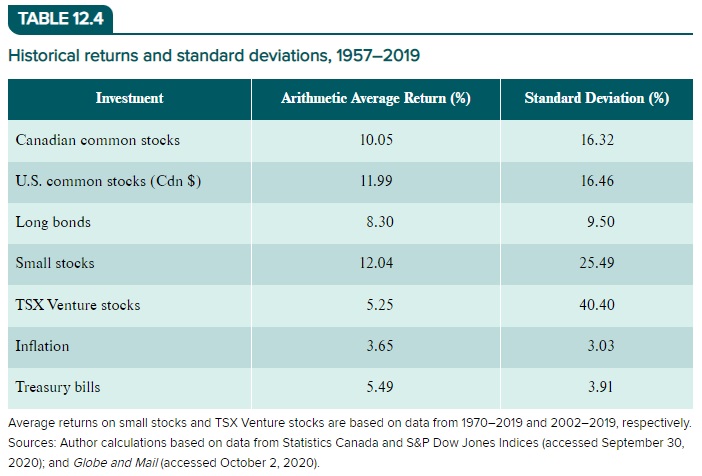

Question: Historical returns and standard deviations, 1 9 5 7 - 2 0 1 9 begin { tabular } { | l | c |

Historical returns and standard deviations,

begintabularlcc

hline multicolumnc Investment & Arithmetic Average Return & Standard Deviation

hline Canadian common stocks & &

hline US common stocks Cdn $ & &

hline Long bonds & &

hline Small stocks & &

hline TSX Venture stocks & &

hline Inflation & &

hline Treasury bills & &

hline

endtabular

Average returns on small stocks and TSX Venture stocks are based on data from and respectively.

Sources: Author calculations based on data from Statistics Canada and S&P Dow Jones Indices accessed September

Sources: Author calculations based on data from Statistics Canada and S&P Dow Jones Indices accessed September

; and Globe and Mail accessed October

; and Globe and Mail accessed October

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock