Question: Hitzu Co . sold a copier ( that costs $ 4 , 5 0 0 ) for $ 9 , 0 0 0 cash with

Hitzu Co sold a copier that costs $ for $ cash with a twoyear parts warranty to a customer on August of Year Hitzu expects warranty costs to be of dollar sales. It records warranty expense with an adjusting entry on December On January of Year the copier requires onsite repairs that are completed the same day. The repairs cost $ for materials taken from the repair parts inventory. These are the only repairs required in Year for this copier.Hitzu Co sold a copier that costs $ for $ cash with a twoyear parts warranty to a customer on August of Year Hitzu Prepare journal entries to record a the copier's sale; b the adjustment to recognize the warranty expense on December of Year

; and c the repairs that occur on January of Year

Record the sale of a copier for $ cash.

Record the cost of goods sold of $

mpleted

Record the estimated warranty expense at of the

air parts

sales.

On January of Year the copier requires onsite

repairs that are completed the same day. The repairs cost

$ for materials taken from the repair parts inventory.

Record the cost of the repair.

expects warranty costs to be of dollar sales. It records warranty expense with an adjusting entry on December On January of

Year the copier requires onsite repairs that are completed the same day. The repairs cost $ for materials taken from the repair

parts inventory. These are the only repairs required in Year for this copier.

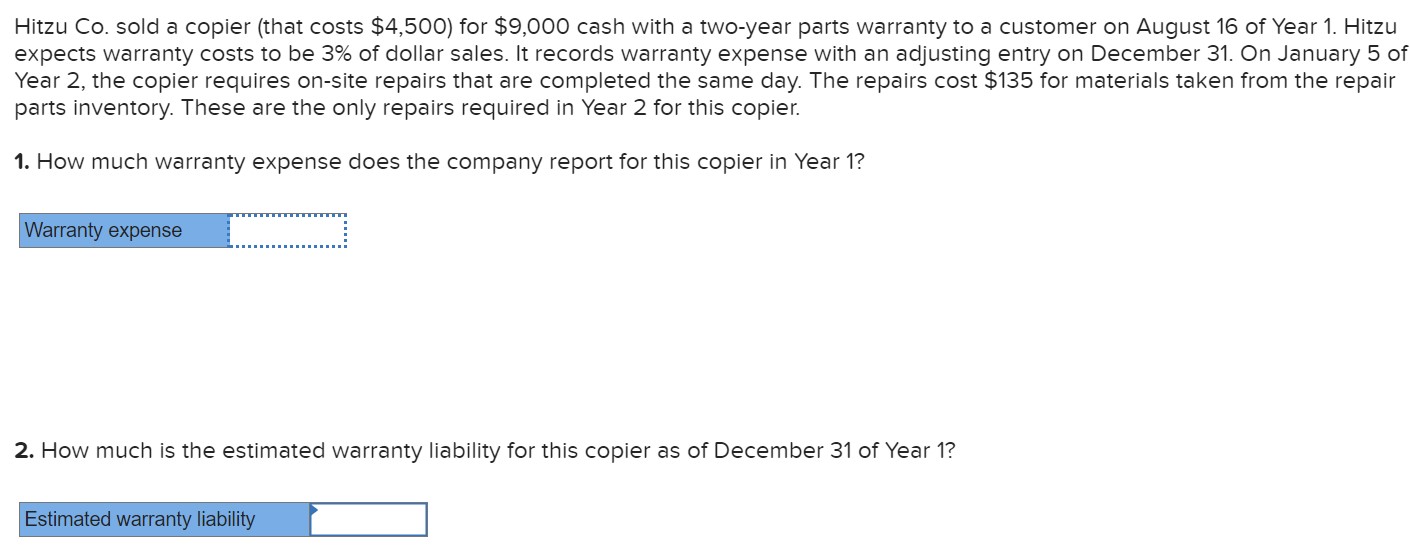

How much warranty expense does the company report for this copier in Year

How much is the estimated warranty liability for this copier as of December of Year

Estimated warranty liability

Four parts to this one questions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock