Question: HMK Enterprises would like to raise ( $ 1 0 . 0 ) million to invest in capital expenditures. The company plans

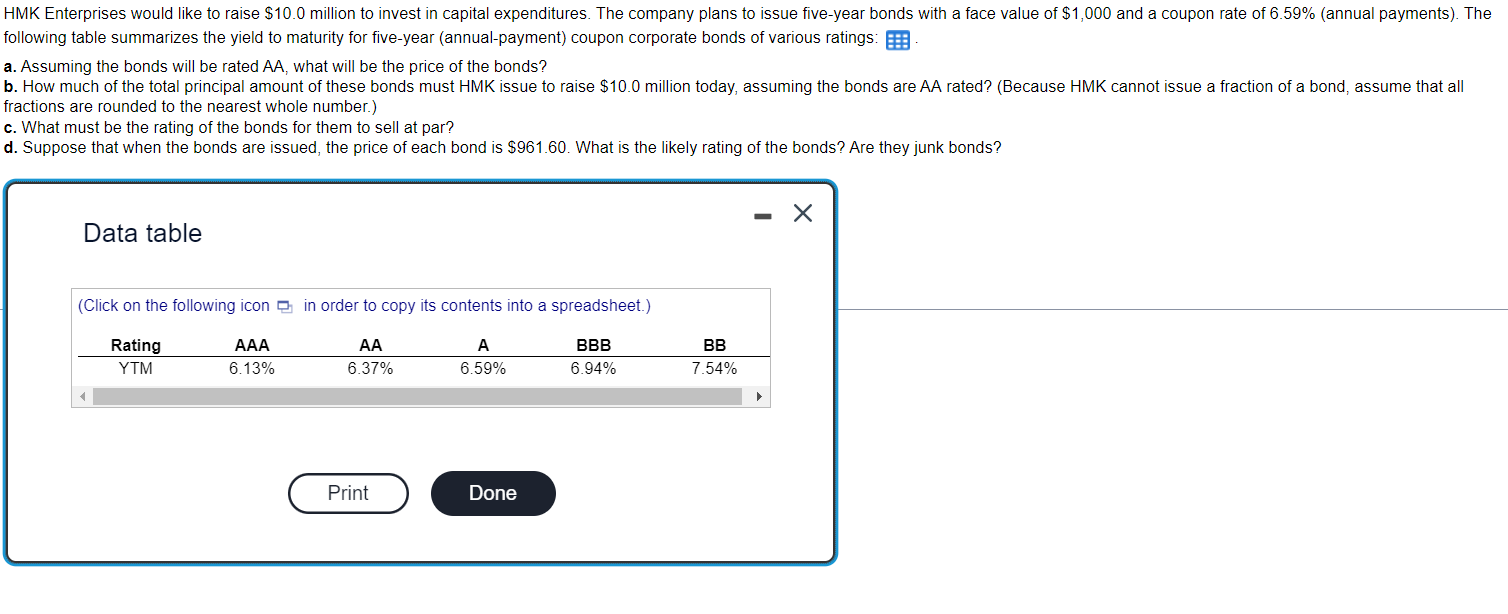

HMK Enterprises would like to raise $ million to invest in capital expenditures. The company plans to issue fiveyear bonds with a face value of $ and a coupon rate of annual payments The following table summarizes the yield to maturity for fiveyear annualpayment coupon corporate bonds of various ratings:

a Assuming the bonds will be rated AA what will be the price of the bonds?

b How much of the total principal amount of these bonds must HMK issue to raise $ million today, assuming the bonds are AA rated? Because HMK cannot issue a fraction of a bond, assume that all fractions are rounded to the nearest whole number.

c What must be the rating of the bonds for them to sell at par?

d Suppose that when the bonds are issued, the price of each bond is $ What is the likely rating of the bonds? Are they junk bonds?

pls helppp!

Data table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock