Question: hneed help for an easy calculation method to understand the problem better. You have two stocks in your portfolio, A and B. Stock A has

hneed help for an easy calculation method to understand the problem better.

hneed help for an easy calculation method to understand the problem better.

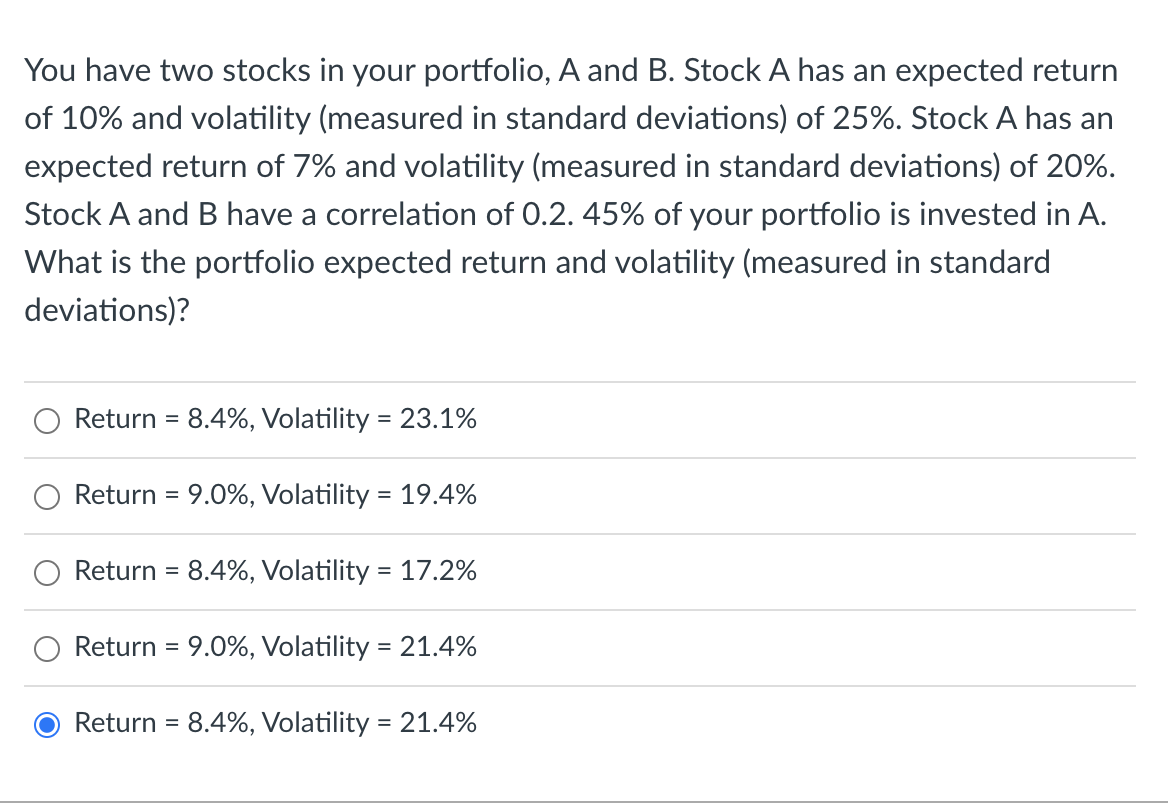

You have two stocks in your portfolio, A and B. Stock A has an expected return of 10% and volatility (measured in standard deviations) of 25%. Stock A has an expected return of 7% and volatility (measured in standard deviations) of 20%. Stock A and B have a correlation of 0.2. 45% of your portfolio is invested in A. What is the portfolio expected return and volatility (measured in standard deviations)? Return = 8.4%, Volatility = 23.1% Return = 9.0%, Volatility = 19.4% Return = 8.4%, Volatility = 17.2% = Return = 9.0%, Volatility = 21.4% = Return = 8.4%, Volatility = 21.4% =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts