Question: Ho nE Ger e on Per Tig anal con per untr 3 % an e 5 1 8 5 3 5 0 6 0 0

Ho nE Ger e on Per Tig anal con per untr an e

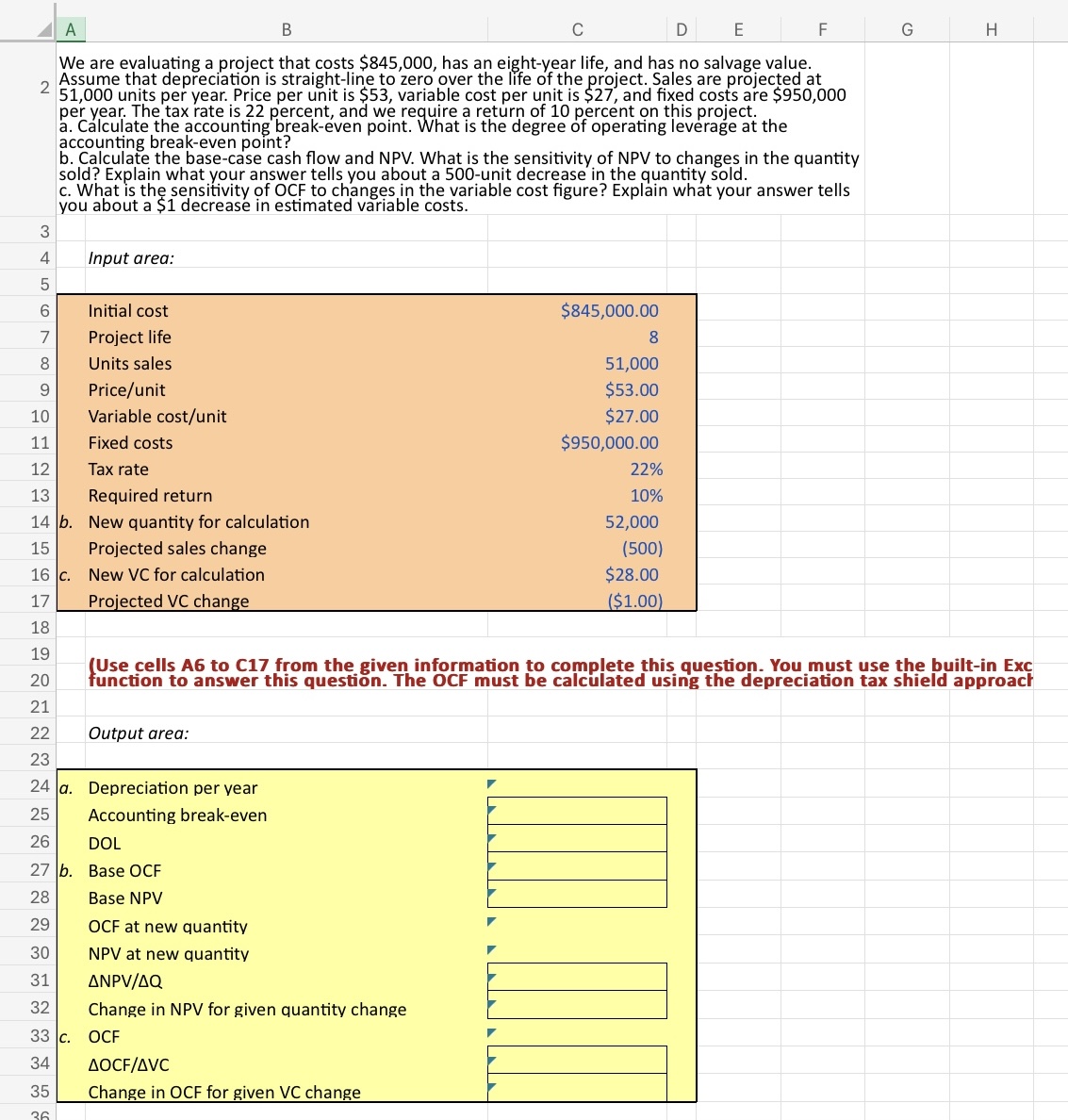

a cyuratee accous in breake en wine Wire is ete deer of operatin his erase at the

accounting breakeven point?

Calculate the basecase cash flow and NPV What is the sensitivity of NPV to changes in the quantity sold? Explain what your answer tells you about a unit decrease in the quantity sold.

What is the sensitivity of OCF to changes in the variable cost figure? Explain what your answer tells you about a S decrease in estimated variable costs.

G

H

a

b

C

Input area:

Initial cost

$

Project life

Units sales

Priceunit

$

Variable costunit

$

Fixed costs

$

Tax rate

Required return

b

New quantity for calculation

Projected sales change

C

New VC for calculation

$

Projected VC change

$

fusellso answer this quese gi Thie oct must be calculated his geese depreciation tae shee baapproach

Output area:

Depreciation per vear

Accounting breakeven

DOL

Base OCF

Base NPV

OCF at new quantity

NPV at new quantity

ANPVAQ

Change in NPV for given quantity change

OCF

AOCFAVC

Change in OF for given VC change

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock