Question: Hocus Pocus Company wants to increase sales by adding a new product line. The company is considering three different projects. However, its capital budget

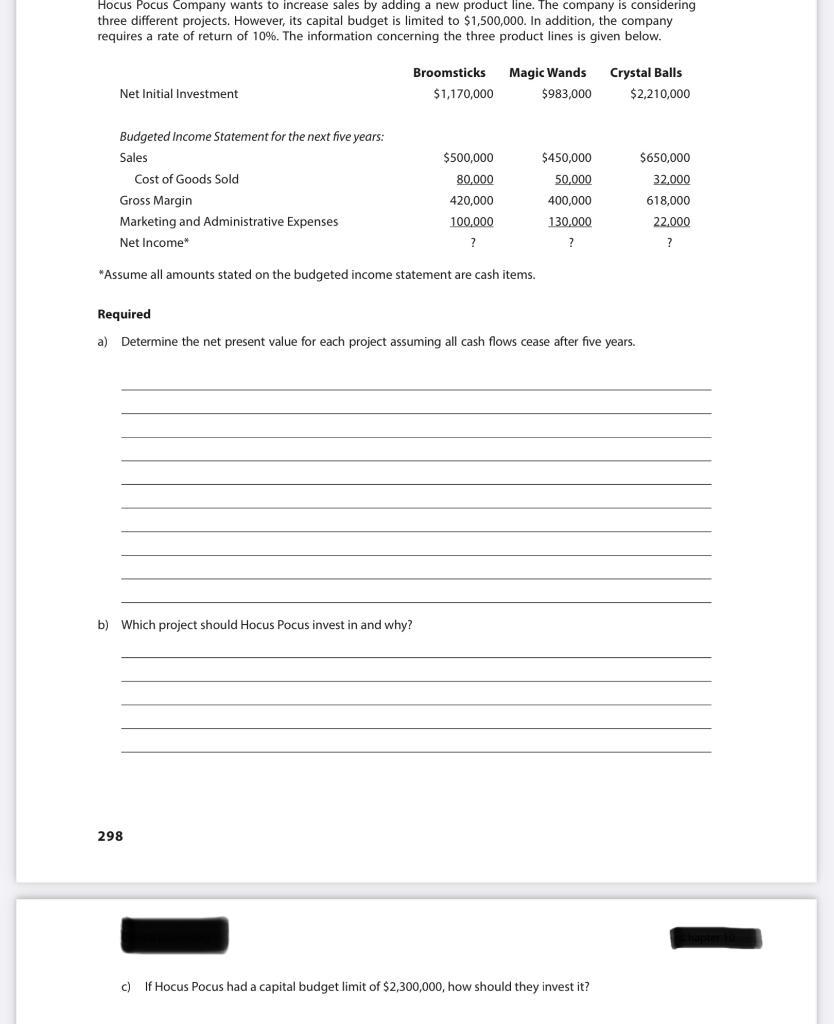

Hocus Pocus Company wants to increase sales by adding a new product line. The company is considering three different projects. However, its capital budget is limited to $1,500,000. In addition, the company requires a rate of return of 10%. The information concerning the three product lines is given below. Net Initial Investment Budgeted Income Statement for the next five years: Sales Cost of Goods Sold Broomsticks $1,170,000 298 $500,000 80,000 420,000 100,000 ? Gross Margin Marketing and Administrative Expenses Net Income* *Assume all amounts stated on the budgeted income statement are cash items. b) Which project should Hocus Pocus invest in and why? Magic Wands $983,000 $450,000 50,000 400,000 130,000 ? Required a) Determine the net present value for each project assuming all cash flows cease after five years. Crystal Balls $2,210,000 c) If Hocus Pocus had a capital budget limit of $2,300,000, how should they invest it? $650,000 32,000 618,000 22,000 ?

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

For Broomsticks Cashflow calculation is given in the table below Sale 500000 Cost of Goods Sold 8000... View full answer

Get step-by-step solutions from verified subject matter experts