Question: HOE Chapter 14 - Bonds Payable Formulas Review Data View Tell me Home Page Layout Insert Draw X 11 Calibri (Body) V La % Conditional

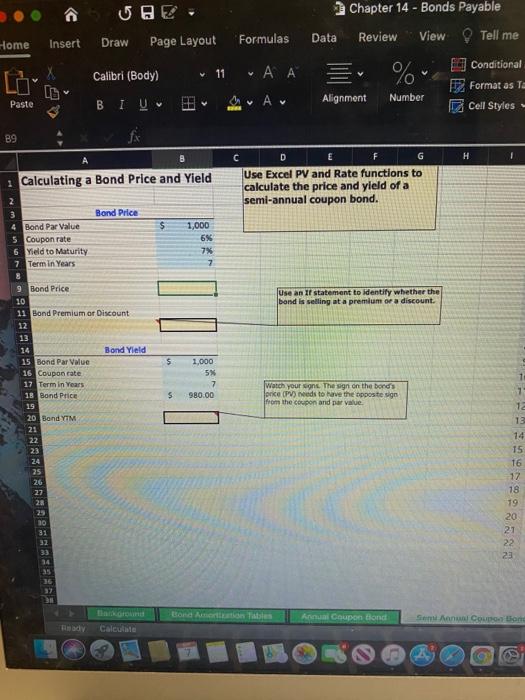

HOE Chapter 14 - Bonds Payable Formulas Review Data View Tell me Home Page Layout Insert Draw X 11 Calibri (Body) V La % Conditional F Format as a Cell Styles Paste & A Number BIU Alignment 89 H A Calculating a Bond Price and Yield C D Use Excel PV and Rate functions to calculate the price and yield of a semi-annual coupon bond. Bond Price $ 4 Bond Par Value 5 Coupon rate 6 Yield to Maturity 7 Term In Years 1,000 6% 7% 7 Use an If statement to identify whether the bond is selling at a premium or a discount. $ 1,000 5% 7 980.00 $ Watch your egne. The sign on the bonds orice (PU) reeds to have the opposte sige from the coupon and per value 9 Bond Price 10 11 Bond Premium or Discount 12 13 14 Bond Yield 15 Bond Par Value 16 Coupon rate 17 Termin Years 18 Band Price 15 20 Bond YTM 21 22 23 24 25 26 27 28 29 10 31 92 33 14 95 36 32 7 13 13 14 15 16 17 18 19 20 21 22 23 A Coupon Bond AwCoun Calculate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts