Question: Holding everything else the same, what is the effect of decreasing 's' on the value of stock? decreases stock value. increases stock value. no effect.

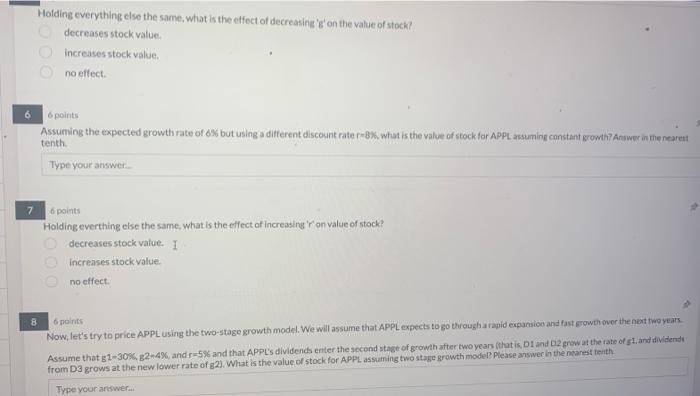

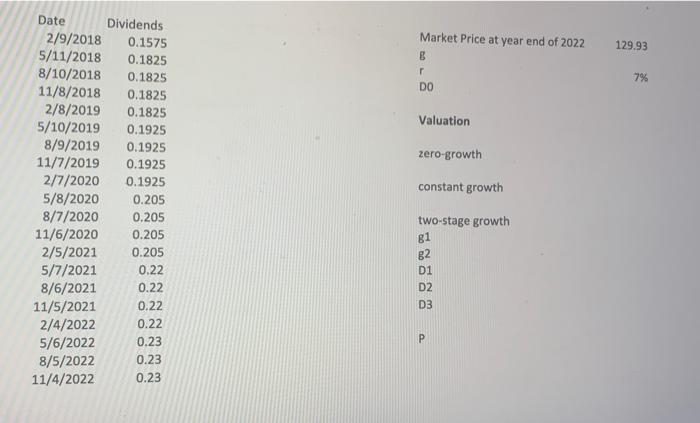

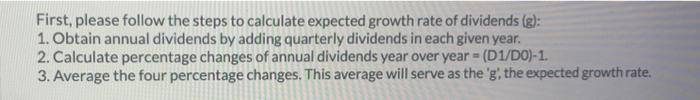

Holding everything else the same, what is the effect of decreasing 's' on the value of stock? decreases stock value. increases stock value. no effect. 6 points Assuming the expected growth rate of 6% but using a different discount rate r=8\%. what is the value of stock far APPL assuming canstant gromth? Answer in the nearea tenth. 6 points Holding everthing else the same, what is the effect of Increasing 'r' on value of stock? decreases stock value. I increases stockvalue. no effect. Now, let's try to price APPL using the two-stage growth model. We will assume that APPL expects to go througha rapid expunision and tast gowth over the nent hwo veans. 6 moints First, please follow the steps to calculate expected growth rate of dividends (g): 1. Obtain annual dividends by adding quarterly dividends in each given year. 2. Calculate percentage changes of annual dividends year over year =(D1/D0)1. 3. Average the four percentage changes. This average will serve as the ' g ' the expected growth rate. Holding everything else the same, what is the effect of decreasing 's' on the value of stock? decreases stock value. increases stock value. no effect. 6 points Assuming the expected growth rate of 6% but using a different discount rate r=8\%. what is the value of stock far APPL assuming canstant gromth? Answer in the nearea tenth. 6 points Holding everthing else the same, what is the effect of Increasing 'r' on value of stock? decreases stock value. I increases stockvalue. no effect. Now, let's try to price APPL using the two-stage growth model. We will assume that APPL expects to go througha rapid expunision and tast gowth over the nent hwo veans. 6 moints First, please follow the steps to calculate expected growth rate of dividends (g): 1. Obtain annual dividends by adding quarterly dividends in each given year. 2. Calculate percentage changes of annual dividends year over year =(D1/D0)1. 3. Average the four percentage changes. This average will serve as the ' g ' the expected growth rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts