Question: Holley Corporation manufactures computer processors for leading computer makers. LOADING... (Click to view additional information.) ... Question content area top right Part 1 The plant's

Holley

Corporation manufactures computer processors for leading computer makers.

LOADING...

(Click to view additional information.)

...

Question content area top right

Part 1

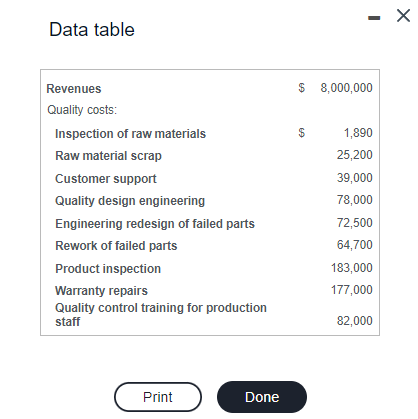

The plant's initial budgeted revenues and quality costs for

2020

are as follows:

LOADING...

(Click the icon to view the budgeted revenues and quality costs for

2020.)

LOADING...

(Click the icon to view

Andrew's

quality options.)Read the requirements

LOADING...

.

Question content area bottom

Part 1

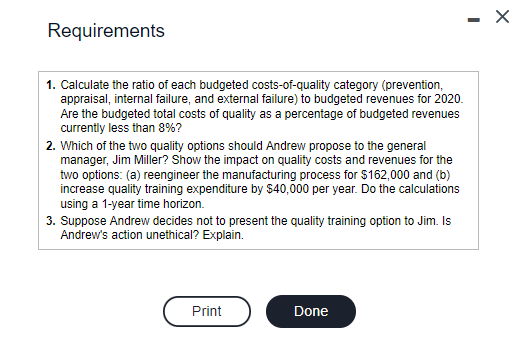

Requirement 1. Calculate the ratio of each budgeted costs-of-quality category (prevention, appraisal, internal failure, and external failure) to budgeted revenues for

2020.

Are the budgeted total costs of quality as a percentage of budgeted revenues currently less than

8%?

Begin by selecting the prevention costs. Calculate the ratio of prevention costs to revenues for

2020,

then continue with appraisal, internal failure and external failure costs. Finally, calculate the total costs of quality and the total percentage of revenues. (Round percentages to two decimal places, X.XX%.)

| Percentage of | |||

| Costs of Quality | Cost | Total Revenue | |

| Prevention Costs | |||

|

|

|

| |

|

|

| ||

|

|

| ||

|

|

| % | |

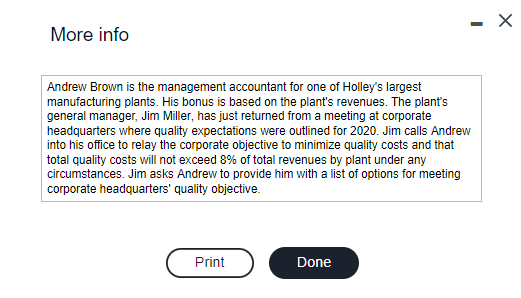

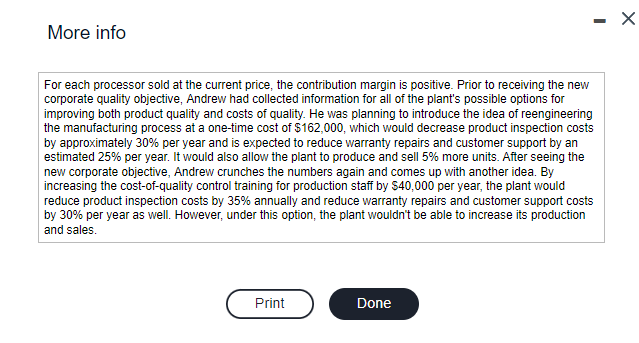

More info Andrew Brown is the management accountant for one of Holley's largest manufacturing plants. His bonus is based on the plant's revenues. The plant's general manager, Jim Miller, has just returned from a meeting at corporate headquarters where quality expectations were outlined for 2020 . Jim calls Andrew into his office to relay the corporate objective to minimize quality costs and that total quality costs will not exceed 8% of total revenues by plant under any circumstances. Jim asks Andrew to provide him with a list of options for meeting corporate headquarters' quality objective. Data table More info For each processor sold at the current price, the contribution margin is positive. Prior to receiving the new corporate quality objective, Andrew had collected information for all of the plant's possible options for improving both product quality and costs of quality. He was planning to introduce the idea of reengineering the manufacturing process at a one-time cost of $162,000, which would decrease product inspection costs by approximately 30% per year and is expected to reduce warranty repairs and customer support by an estimated 25% per year. It would also allow the plant to produce and sell 5% more units. After seeing the new corporate objective, Andrew crunches the numbers again and comes up with another idea. By increasing the cost-of-quality control training for production staff by $40,000 per year, the plant would reduce product inspection costs by 35% annually and reduce warranty repairs and customer support costs by 30% per year as well. However, under this option, the plant wouldn't be able to increase its production and sales. Requirements 1. Calculate the ratio of each budgeted costs-of-quality category (prevention, appraisal, internal failure, and external failure) to budgeted revenues for 2020 . Are the budgeted total costs of quality as a percentage of budgeted revenues currently less than 8% ? 2. Which of the two quality options should Andrew propose to the general manager, Jim Miller? Show the impact on quality costs and revenues for the two options: (a) reengineer the manufacturing process for $162,000 and (b) increase quality training expenditure by $40,000 per year. Do the calculations using a 1-year time horizon. 3. Suppose Andrew decides not to present the quality training option to Jim. Is Andrew's action unethical? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts