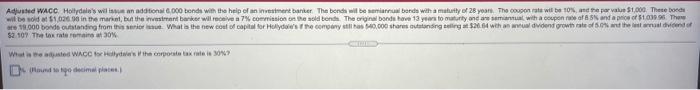

Question: Hollydale's will issue an additional 6,000 bomds with the help of an investment banker. The homds will be semianuual bonds with a maturity of 28

A WACC www.debeant Theoben we een here.000 willet 20. no more than one comment on the world 10.000Mom Tissen Wat een coal to the cowy 40.000 de groter at dhe $2.107 The aromas What is adjusts WACC Sales comptes 304 Round to be decimal places Adjunte WACC Hotel's wil is an additions 6.000 bonds with the help of an investment banker The bonds will be in bords with a matuity of 28 years. The coupon rate will be 10% per value $1.000. These boede will be sold at $1,020 in the market, but the investmentbarke will receive a commission on the sold on the original bands have 13 years to turty and area with a coupons and post 51.030.06. There 18,000 borde outstanding from it. What is the new cost of capital for Hollydoles The company has 0.000 shares outstanding 20. wth an oldvidend growth rate of the talento 52.109 The tax ratom 30% Wat e WACC Wor's the corporate taxi Dopo decimal plane

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts