Question: Holp Save 8 Exit Submit 3 rief Exercise 1 8 - 1 2 ( Algo ) Property dividend [ LO 1 8 - 7 ]

Holp

Save Exit

Submit

rief Exercise Algo Property dividend LO

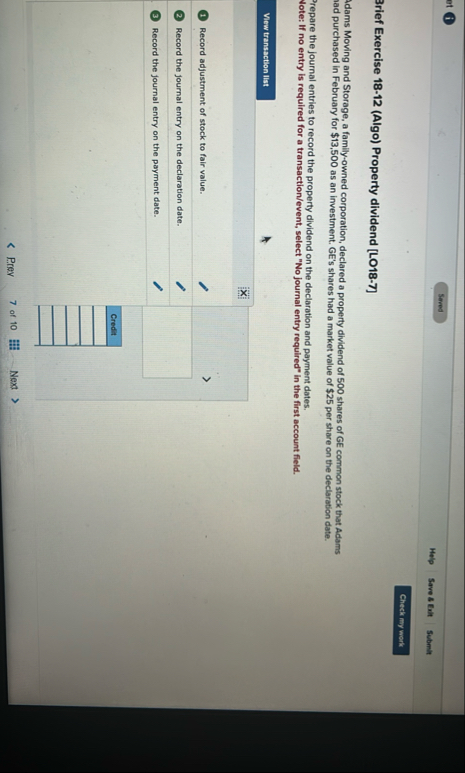

Adams Moving and Storage, a familyowned corporation, declared a property dividend of shares of GE common stock that Adams ad purchased in February for $ as an investment. GE's shares had a market value of $ per share on the declaration date.

Prepare the journal entries to record the property dividend on the declaration and payment dates.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Record adjustment of stock to fair value.

Record the journal entry on the declaration date.

Record the journal entry on the payment date.

Credit

Prey

of

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock