Question: Home assignment 5 This is a comprehensive project evaluation problem bringing together much of what you have learned so far. Company ABC is a large

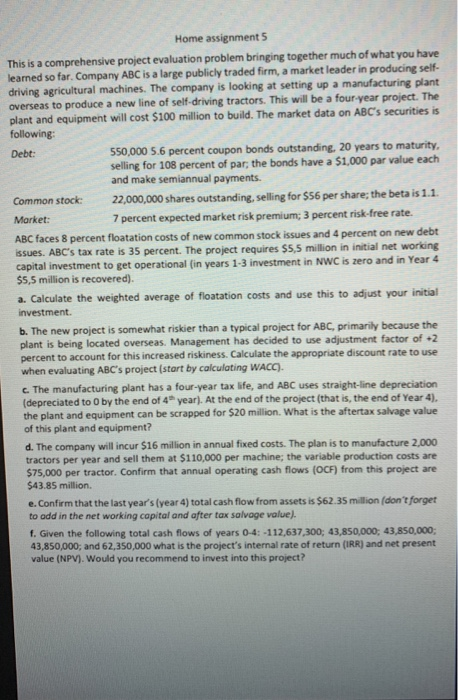

Home assignment 5 This is a comprehensive project evaluation problem bringing together much of what you have learned so far. Company ABC is a large publicly traded firm, a market leader in producing self- driving agricultural machines. The company is looking at setting up a manufacturing plant Overseas to produce a new line of self-driving tractors. This will be a four-year project. The plant and equipment will cost $100 million to build. The market data on ABC's securities is following: Debt: 550.000 5.6 percent coupon bonds outstanding, 20 years to maturity, selling for 108 percent of par; the bonds have a $1,000 par value each and make semiannual payments. Common stock: 22,000,000 shares outstanding, selling for $56 per share; the beta is 1.1. Market: 7 percent expected market risk premium; 3 percent risk-free rate. ABC faces 8 percent floatation costs of new common stock issues and 4 percent on new debt issues. ABC's tax rate is 35 percent. The project requires $5,5 million in initial net working capital investment to get operational (in years 1-3 investment in NWC is zero and in Year 4 $5,5 million is recovered). a. Calculate the weighted average of floatation costs and use this to adjust your initial investment. b. The new project is somewhat riskier than a typical project for ABC, primarily because the plant is being located overseas. Management has decided to use adjustment factor of 2 percent to account for this increased riskiness. Calculate the appropriate discount rate to use when evaluating ABC's project stort by calculating WACC). c. The manufacturing plant has a four-year tax life, and ABC uses straight-line depreciation (depreciated to O by the end of 4 year). At the end of the project that is, the end of Year 4). the plant and equipment can be scrapped for $20 million. What is the aftertax salvage value of this plant and equipment? d. The company will incur $16 million in annual fixed costs. The plan is to manufacture 2.000 tractors per year and sell them at $110,000 per machine; the variable production costs are $75,000 per tractor. Confirm that annual operating cash flows (OCF) from this project are $43.85 million. e. Confirm that the last year's (year 4) total cash flow from assets is $62.35 million (don't forget to add in the networking capital and after tax salvage value). 1. Given the following total cash flows of years 0-4: -112,637,300: 43,850,000: 43.850.000, 43,850,000; and 62,350,000 what is the project's internal rate of return (IRR) and net present value (NPV). Would you recommend to invest into this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts