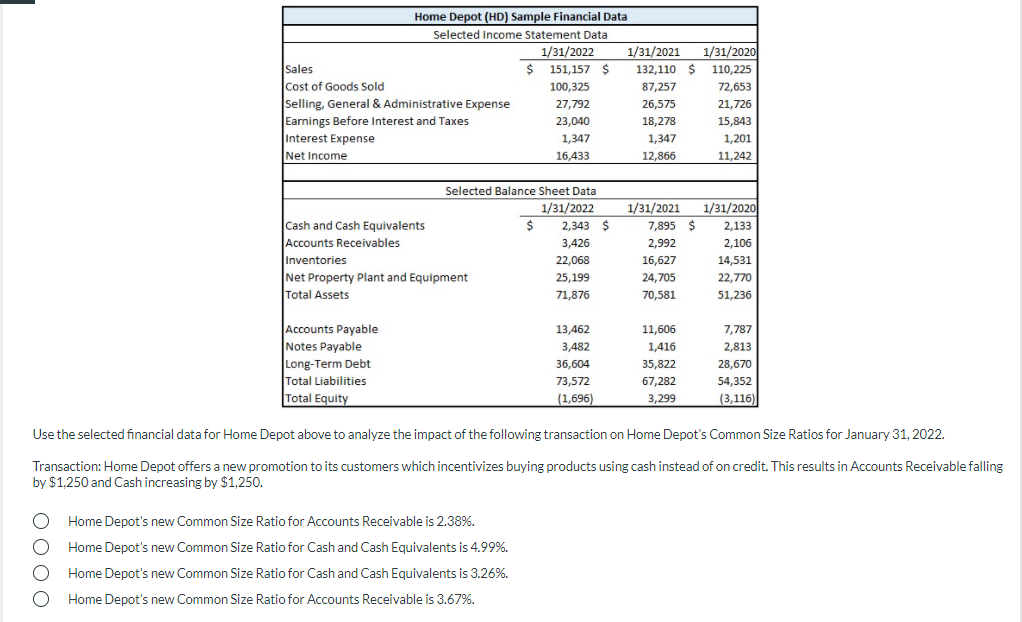

Question: Home Depot (HD) Sample Financial Data Selected Income Statement Data 1/31/2022 1/31/2021 1/31/2020 Sales $ 151, 157 $ 132,110 $ 110,225 Cost of Goods Sold

Home Depot (HD) Sample Financial Data Selected Income Statement Data 1/31/2022 1/31/2021 1/31/2020 Sales $ 151, 157 $ 132,110 $ 110,225 Cost of Goods Sold 100,325 87,257 72,653 Selling, General & Administrative Expense 27,792 26,575 21,726 Earnings Before Interest and Taxes 23,040 18,278 15,843 Interest Expense 1,347 1,347 1,201 Net Income 16,433 12.866 11,242 Selected Balance Sheet Data 1/31/2022 Cash and Cash Equivalents $ 2,343 $ Accounts Receivables 3,426 Inventories 22,068 Net Property Plant and Equipment 25,199 Total Assets 71,876 1/31/2021 7,895 $ 2,992 16,627 24,705 70,581 1/31/2020 2,133 2,106 14,531 22,770 51,236 Accounts Payable Notes Payable Long-Term Debt Total Liabilities Total Equity 13,462 3,482 36,604 73,572 (1,696) 11,606 1,416 35,822 67,282 3,299 7,787 2,813 28,670 54,352 (3,116) Use the selected financial data for Home Depot above to analyze the impact of the following transaction on Home Depot's Common Size Ratios for January 31, 2022. Transaction: Home Depot offers a new promotion to its customers which incentivizes buying products using cash instead of on credit. This results in Accounts Receivable falling by $1,250 and Cash increasing by $1,250. Home Depot's new Common Size Ratio for Accounts Receivable is 2.38%. Home Depot's new Common Size Ratio for Cash and Cash Equivalents is 4.99%. Home Depot's new Common Size Ratio for Cash and Cash Equivalents is 3.26%. Home Depot's new Common Size Ratio for Accounts Receivable is 3.67%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts