Question: Home loans typically involve points, which are fees charged by the lender. Each point charged means that the borrower must pay 1% of the loan

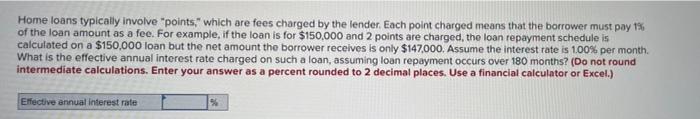

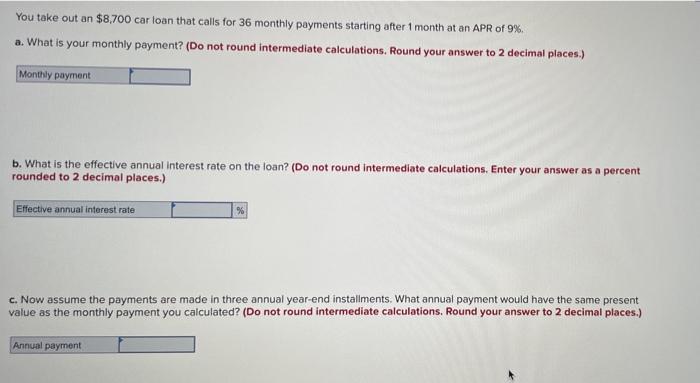

Home loans typically involve "points," which are fees charged by the lender. Each point charged means that the borrower must pay 1% of the loan amount as a fee. For example, if the loan is for $150,000 and 2 points are charged, the loan repayment schedule is calculated on a $150,000 loan but the net amount the borrower receives is only $147,000. Assume the interest rate is 100% per month What is the effective annual interest rate charged on such a loan, assuming loan repayment occurs over 180 months? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Use a financial calculator or Excel.) Effective annual interest rate You take out an $8,700 car loan that calls for 36 monthly payments starting after 1 month at an APR of 9% a. What is your monthly payment? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Monthly payment b. What is the effective annual interest rate on the loan? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual interest rate % c. Now assume the payments are made in three annual year-end installments. What annual payment would have the same present value as the monthly payment you calculated? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Annual payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts