Question: Home Page Layout Formu Data Review View Developer Help MP Central X CHE I Copy font Pane Opboard 11 - A A - A-- UW.pt

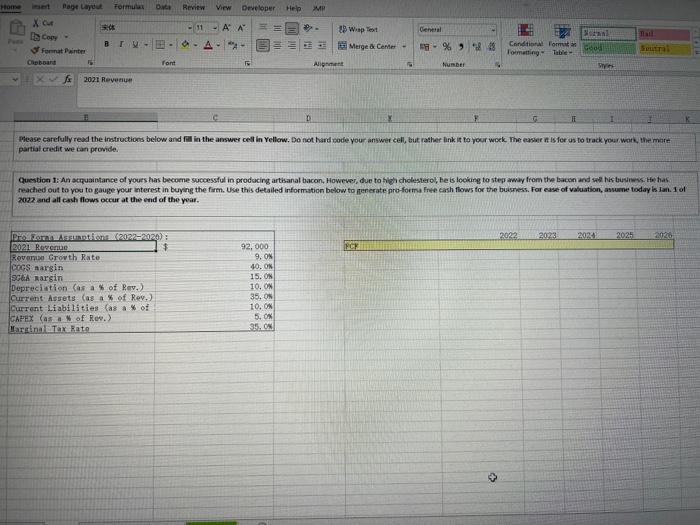

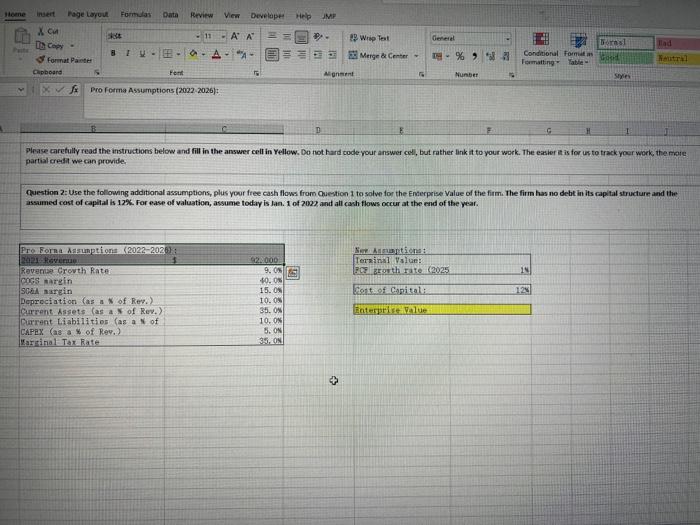

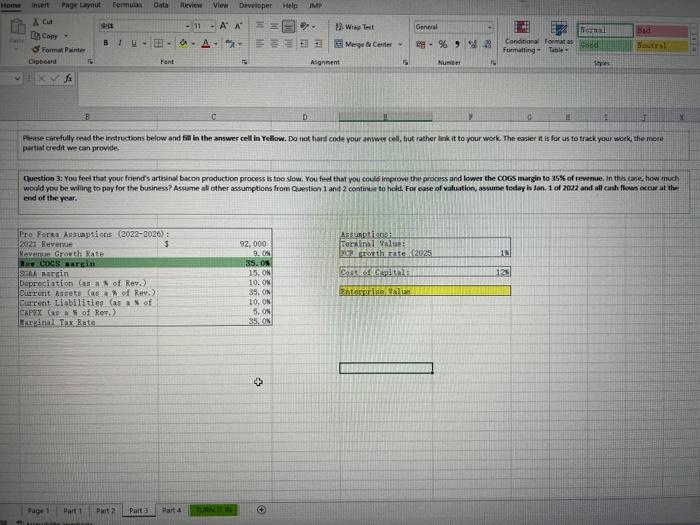

Home Page Layout Formu Data Review View Developer Help MP Central X CHE I Copy font Pane Opboard 11 - A A - A-- UW.pt Merge & Center - B TV- 17 % 94 Conditional Format Formatting Table od font Alignment Number SY A 2021 Revenue D TE Please carefully read the instructions below and fill in the answer cell in Yellow. Do not hard code your answer cell, but rather link it to your work. The easier for us to track your work, the more partial credit we can provide Question 1: An acquaintance of yours has become successful in producing artisanal bacon, However, due to high cholesterol, he is looking to step away from the bacon and all his buss. He has reached out to you to gauge your interest in buying the form. Use this detailed information below to generate proforma Free cash flows for the business. For ease of valuation, assume today is lan 1 of 2022 and all cash flows occur at the end of the year. 2022 2023 2021 2025 2920 PCH Anton12022-2020); 2021 Revenue Roven Growth Rate COGS margin Sol Marsin Depreciation (as a % of Rav.) Current Assets (as a % of Rey.) Current Liabilities (as a % of CAPEX (as of Rev.) Harginal Tax Eato 92,000 9. ON 40. ON 15. ON 10. ON 35. ON 10. ON 5. ON 35.0 Stone Data Review View Developer Help JMP General Page Layout Formulas X CM Cory BTW- Format Painter Cupboard 11 HA A - A-- Bras! Mlad Wrip Test Merge Center - . % ** Conditional Fom Formatting Yata Neutral Fent Mont Number Styles f Pro Forma Assumptions (2022 2026): Please carefully read the instructions below and fill in the answer cell in Yellow. Do not hard code your answer coll, but rather link it to your work. The easier it is for us to track your work, the more partial credit we can provide Question 2: Use the following additional assumptions, plus your free cash flows from Question 1 to solve for the Enterprise Value of the film. The firm has no debt in its capital structure and the assumed cost of capital is 12%. For ease of valuation, assume today is Jan. 1 of 2022 and all cash flows occur at the end of the year. 922000 Anuptions: Terkinil Value: FC Both rate 2025 9.s 1 12 Pro Forma Assumptions (2022 2026): 2021 Ravenue Revenue Crowth Rate ICOS margin SOGA margin Depreciation (as a % of Rev.) Current Assets (as a of Rev.) Current Liabilities (as a of CAPEX (as a % of Rev. Martinal Tax Rate 30.0 15. ON 10. ON 35. ON 10. ON 5. ON 39. ON Bet of Capital: Enterpr2100 > > Help IMP - 12 Will General Home Page Layout Fermuas Data Review View Developer - 11AA E Le Copy BIU... A. Format Painter Dipboard Font BA Mege & Cie 19. % 91 Conditional formats Formatting - Table es Stra! Algnent 15 NUS 19 D Please carefully read the instructions below and fill in the answer cell in Yellow. Do not hard code your anwer cell, but rather link it to your work. The easier it is for us to track your work, the more purtat credit we can provide Question 3: You feel that your friends artisinal bacon production process is too slow. You feel that you could improve the process and lower the COGS margin to 35% of revenue. In this case, how much would you be willing to pay for the business? Assume all other assumptions from Question 1 and 2 continue to hold. For ease of valuation, assume today is Jan. 1 of 2022 and all cash lows occur at the end of the year. Absurption Terminal Values Forth rate (2025 15 Cesto Capitals 12 Pro Porta Assumptions (2022-2026) : 2021 Revenue 3 Revenue Growth Bate er CO sariin So margin Depreciation of Rev.) Current Assets of Rev.) Current Liabilities (ara of CAPEX (as as of Rer.) Karpinal Tax Rate 92,000 9. ON 35. ON 15. ON 10. ON 35. ON 10. ON 5. ON 35.ON Enterprise + Pace Part 1 PART 2 Paita Part 4 Home Page Layout Formu Data Review View Developer Help MP Central X CHE I Copy font Pane Opboard 11 - A A - A-- UW.pt Merge & Center - B TV- 17 % 94 Conditional Format Formatting Table od font Alignment Number SY A 2021 Revenue D TE Please carefully read the instructions below and fill in the answer cell in Yellow. Do not hard code your answer cell, but rather link it to your work. The easier for us to track your work, the more partial credit we can provide Question 1: An acquaintance of yours has become successful in producing artisanal bacon, However, due to high cholesterol, he is looking to step away from the bacon and all his buss. He has reached out to you to gauge your interest in buying the form. Use this detailed information below to generate proforma Free cash flows for the business. For ease of valuation, assume today is lan 1 of 2022 and all cash flows occur at the end of the year. 2022 2023 2021 2025 2920 PCH Anton12022-2020); 2021 Revenue Roven Growth Rate COGS margin Sol Marsin Depreciation (as a % of Rav.) Current Assets (as a % of Rey.) Current Liabilities (as a % of CAPEX (as of Rev.) Harginal Tax Eato 92,000 9. ON 40. ON 15. ON 10. ON 35. ON 10. ON 5. ON 35.0 Stone Data Review View Developer Help JMP General Page Layout Formulas X CM Cory BTW- Format Painter Cupboard 11 HA A - A-- Bras! Mlad Wrip Test Merge Center - . % ** Conditional Fom Formatting Yata Neutral Fent Mont Number Styles f Pro Forma Assumptions (2022 2026): Please carefully read the instructions below and fill in the answer cell in Yellow. Do not hard code your answer coll, but rather link it to your work. The easier it is for us to track your work, the more partial credit we can provide Question 2: Use the following additional assumptions, plus your free cash flows from Question 1 to solve for the Enterprise Value of the film. The firm has no debt in its capital structure and the assumed cost of capital is 12%. For ease of valuation, assume today is Jan. 1 of 2022 and all cash flows occur at the end of the year. 922000 Anuptions: Terkinil Value: FC Both rate 2025 9.s 1 12 Pro Forma Assumptions (2022 2026): 2021 Ravenue Revenue Crowth Rate ICOS margin SOGA margin Depreciation (as a % of Rev.) Current Assets (as a of Rev.) Current Liabilities (as a of CAPEX (as a % of Rev. Martinal Tax Rate 30.0 15. ON 10. ON 35. ON 10. ON 5. ON 39. ON Bet of Capital: Enterpr2100 > > Help IMP - 12 Will General Home Page Layout Fermuas Data Review View Developer - 11AA E Le Copy BIU... A. Format Painter Dipboard Font BA Mege & Cie 19. % 91 Conditional formats Formatting - Table es Stra! Algnent 15 NUS 19 D Please carefully read the instructions below and fill in the answer cell in Yellow. Do not hard code your anwer cell, but rather link it to your work. The easier it is for us to track your work, the more purtat credit we can provide Question 3: You feel that your friends artisinal bacon production process is too slow. You feel that you could improve the process and lower the COGS margin to 35% of revenue. In this case, how much would you be willing to pay for the business? Assume all other assumptions from Question 1 and 2 continue to hold. For ease of valuation, assume today is Jan. 1 of 2022 and all cash lows occur at the end of the year. Absurption Terminal Values Forth rate (2025 15 Cesto Capitals 12 Pro Porta Assumptions (2022-2026) : 2021 Revenue 3 Revenue Growth Bate er CO sariin So margin Depreciation of Rev.) Current Assets of Rev.) Current Liabilities (ara of CAPEX (as as of Rer.) Karpinal Tax Rate 92,000 9. ON 35. ON 15. ON 10. ON 35. ON 10. ON 5. ON 35.ON Enterprise + Pace Part 1 PART 2 Paita Part 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts