Question: Home Team Exam 01 data Insert Draw Page Layout Formulas Data Review View Tell me Calibri (Body) | 11 DA B 1 UA 2 Wrap

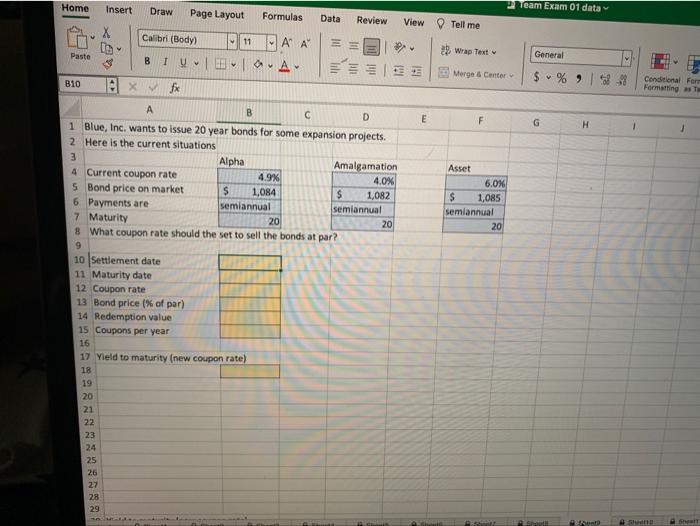

Home Team Exam 01 data Insert Draw Page Layout Formulas Data Review View Tell me Calibri (Body) | 11 DA B 1 UA 2 Wrap Text Paste General Merge & Center $ % 918 B10 Xfx Conditional For Formatting a E F G H 1 Asset A B C D 1 Blue, Inc. wants to issue 20 year bonds for some expansion projects. 2 Here is the current situations 3 Alpha Amalgamation 4 Current coupon rate 4.9% 4.0% 5 Bond price on market $ 1,084 $ 1,082 6 Payments are semiannual semiannual 7 Maturity 20 20 8 What coupon rate should the set to sell the bonds at par? 6.0% $ 1,085 semiannual 20 9 10 Settlement date 11 Maturity date 12 Coupon rate 13 Bond price (% of par) 14 Redemption value 15 Coupons per year 16 17 Yield to maturity (new coupon rate) 18 19 20 21 22 23 24 25 26 27 28 29 Sot et he

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts