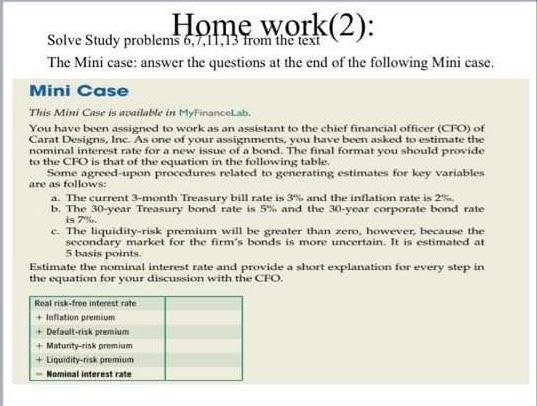

Question: Home work(2): Solve Study problems 6,7,11.13 from the text The Mini case: answer the questions at the end of the following Mini case, Mini Case

Home work(2): Solve Study problems 6,7,11.13 from the text The Mini case: answer the questions at the end of the following Mini case, Mini Case This Mini Case is wailable in MyFinancelab. You have been assigned to work as an assistant to the chief financial officer (CFO) of Carat Designs, Inc. As one of your assignments, you have been asked to estimate the nominal interest rate for a new issue of a bond. The final format you should provide Some agreed-upon procedures related to generating estimates for key variables are as follows: a. The current 3-month Treasury bill rate is 3 and the intation rate is 2 b. The 30-year Treasury bond rate is 5% and the 30-year corporate bond rate is 7%. c. The liquidity-risk premium will be greater than zero, however, because the secondary market for the firm's bonds is more uncertain. It is estimated at 5 basis points Estimate the nominal interest rate and provide a short explanation for every step in the equation for your discussion with the CFO. Real risk-free interest rate +Inflation premium + Default-risk premium + Matunity-risk promium + Liquidity-risk premium Nominal interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts