Question: Homework 1: Capital Cost Allowance (10 points) Mark is the sole proprietor of Mark Enterprises. Mark Enterprises closes its books on December 31 and on

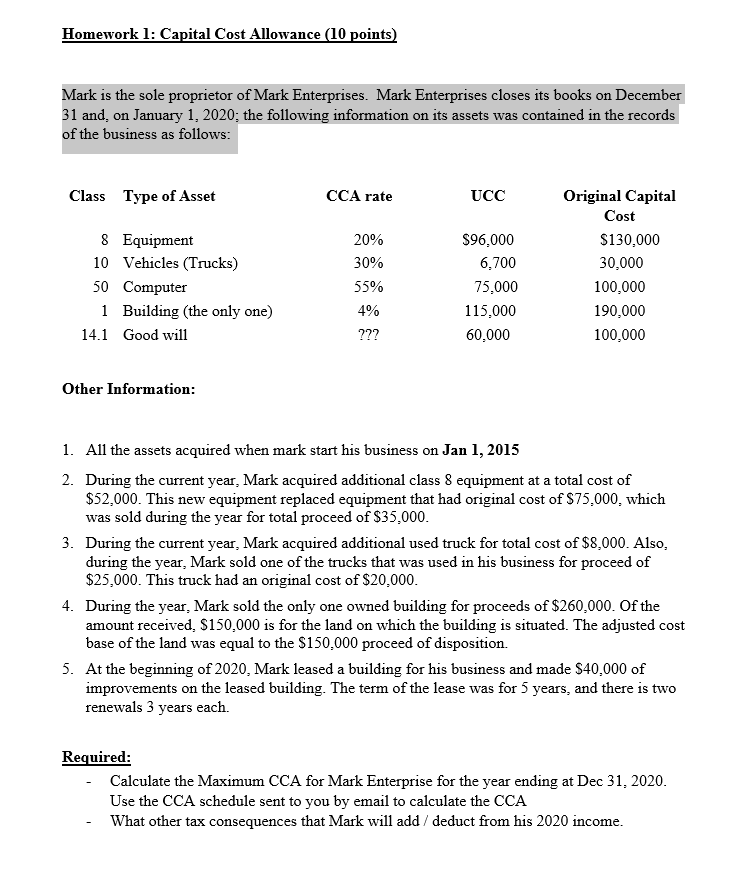

Homework 1: Capital Cost Allowance (10 points) Mark is the sole proprietor of Mark Enterprises. Mark Enterprises closes its books on December 31 and on January 1, 2020; the following information on its assets was contained in the records of the business as follows: Class Type of Asset CCA rate UCC 8 Equipment 10 Vehicles (Trucks) 50 Computer 1 Building (the only one) 14.1 Good will 20% 30% 55% 4% ??? $96,000 6,700 75,000 115,000 60,000 Original Capital Cost $130,000 30,000 100,000 190,000 100,000 Other Information: 1. All the assets acquired when mark start his business on Jan 1, 2015 2. During the current year, Mark acquired additional class 8 equipment at a total cost of $52,000. This new equipment replaced equipment that had original cost of $75,000, which was sold during the year for total proceed of $35,000. 3. During the current year, Mark acquired additional used truck for total cost of $8,000. Also, during the year, Mark sold one of the trucks that was used in his business for proceed of $25,000. This truck had an original cost of $20,000. 4. During the year, Mark sold the only one owned building for proceeds of $260,000. Of the amount received, $150.000 is for the land on which the building is situated. The adjusted cost base of the land was equal to the $150.000 proceed of disposition. 5. At the beginning of 2020, Mark leased a building for his business and made $40,000 of improvements on the leased building. The term of the lease was for 5 years, and there is two renewals 3 years each. Required: - Calculate the Maximum CCA for Mark Enterprise for the year ending at Dec 31, 2020. Use the CCA schedule sent to you by email to calculate the CCA What other tax consequences that Mark will add / deduct from his 2020 income. Homework 1: Capital Cost Allowance (10 points) Mark is the sole proprietor of Mark Enterprises. Mark Enterprises closes its books on December 31 and on January 1, 2020; the following information on its assets was contained in the records of the business as follows: Class Type of Asset CCA rate UCC 8 Equipment 10 Vehicles (Trucks) 50 Computer 1 Building (the only one) 14.1 Good will 20% 30% 55% 4% ??? $96,000 6,700 75,000 115,000 60,000 Original Capital Cost $130,000 30,000 100,000 190,000 100,000 Other Information: 1. All the assets acquired when mark start his business on Jan 1, 2015 2. During the current year, Mark acquired additional class 8 equipment at a total cost of $52,000. This new equipment replaced equipment that had original cost of $75,000, which was sold during the year for total proceed of $35,000. 3. During the current year, Mark acquired additional used truck for total cost of $8,000. Also, during the year, Mark sold one of the trucks that was used in his business for proceed of $25,000. This truck had an original cost of $20,000. 4. During the year, Mark sold the only one owned building for proceeds of $260,000. Of the amount received, $150.000 is for the land on which the building is situated. The adjusted cost base of the land was equal to the $150.000 proceed of disposition. 5. At the beginning of 2020, Mark leased a building for his business and made $40,000 of improvements on the leased building. The term of the lease was for 5 years, and there is two renewals 3 years each. Required: - Calculate the Maximum CCA for Mark Enterprise for the year ending at Dec 31, 2020. Use the CCA schedule sent to you by email to calculate the CCA What other tax consequences that Mark will add / deduct from his 2020 income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts