Question: Homework 1 Chapter 5 1. Using the American term quotes from Exhibit 5.4, calculate the one-, three-, and six-month forward cross-exchange rates between the Australian

Homework 1 Chapter 5

Homework 1 Chapter 5

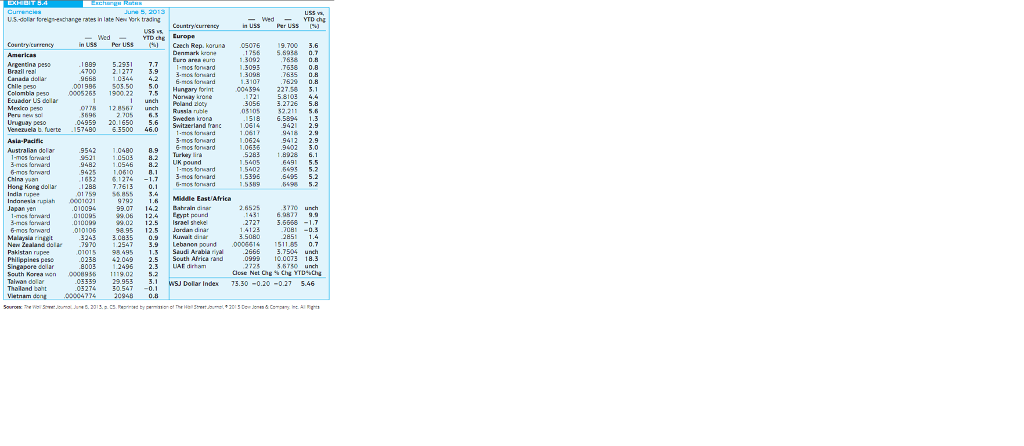

1. Using the American term quotes from Exhibit 5.4, calculate the one-, three-, and six-month forward cross-exchange rates between the Australian dollar and the Swiss franc. State the forward cross-rates in Australian terms.

2. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the Japanese yen versus the U.S. dollar using American term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?

3. Doug Bernard specializes in cross-rate arbitrage. He notices the following quotes:

Swiss franc/dollar = SFr1.5971?$

Australian dollar/U.S. dollar = A$1.8215/$

Australian dollar/Swiss franc = A$1.1440/SFr

Ignoring transaction costs, does Doug Bernard have an arbitrage opportunity based on these quotes? If there is an arbitrage opportunity, what steps would he take to make an arbitrage profit, and how would he profit if he has $1,000,000 available for this purpose.

US dollar foreign-e charge in late NewVork trading Country currency Argentina peso Canada dolla DO1985 505.50 Hong Kong dollar Malaysia ringi Philippines peso Singapore Czech Rep Hungary forint Norway Turkey abia riyal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts