Question: Homework 10 i Saved Help Save & Exit Submit 10 Check my work 2 ! Required information (The following information applies to the questions displayed

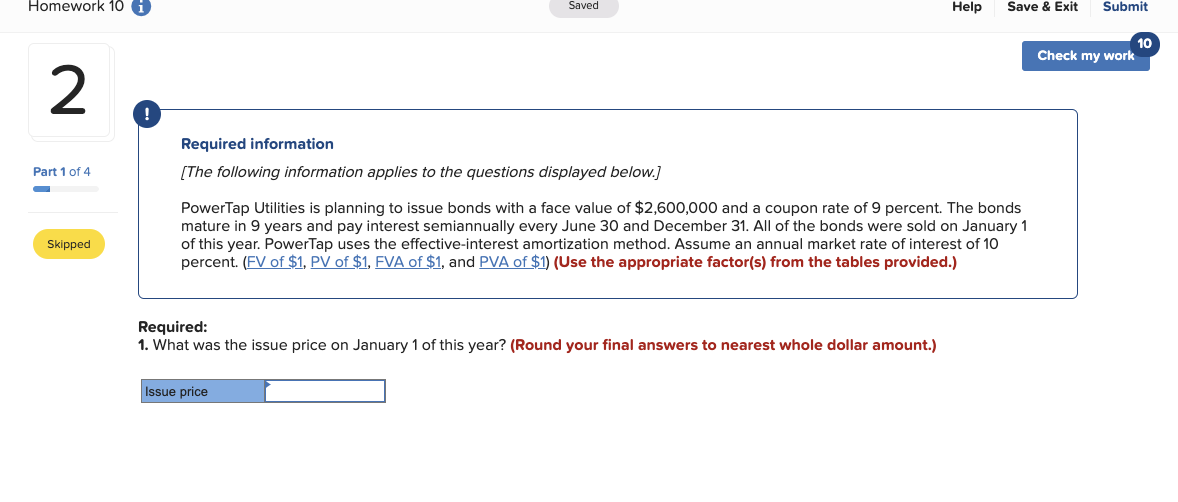

Homework 10 i Saved Help Save & Exit Submit 10 Check my work 2 ! Required information (The following information applies to the questions displayed below.) Part 1 of 4 PowerTap Utilities is planning to issue bonds with a face value of $2,600,000 and a coupon rate of 9 percent. The bonds mature in 9 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. PowerTap uses the effective-interest amortization method. Assume an annual market rate of interest of 10 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Skipped Required: 1. What was the issue price on January 1 of this year? (Round your final answers to nearest whole dollar amount.) Issue price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts