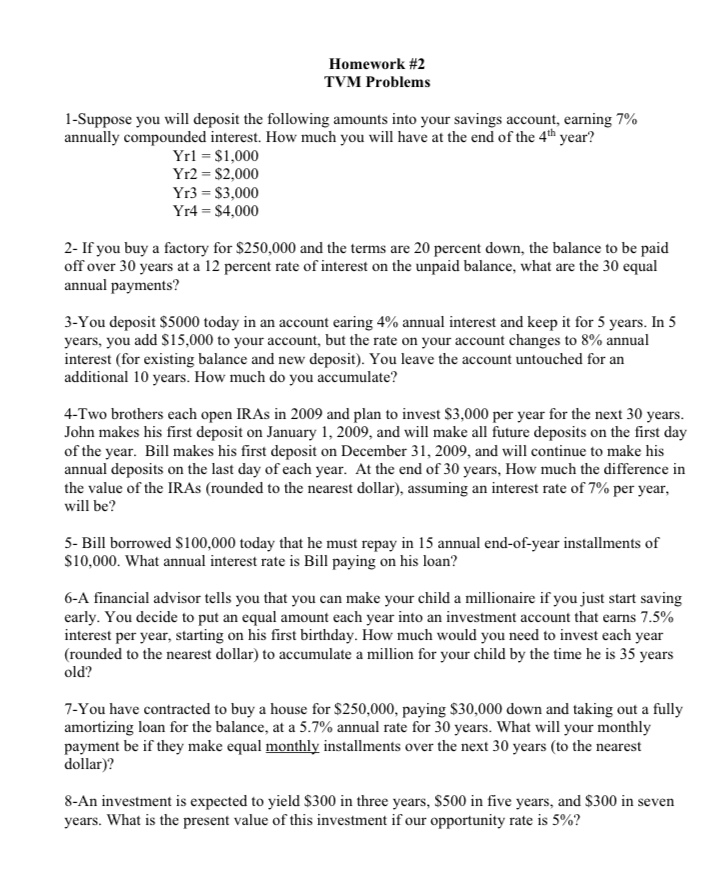

Question: Homework # 2 TVM Problems 1 - Suppose you will deposit the following amounts into your savings account, earning 7 % annually compounded interest. How

Homework # TVM Problems

Suppose you will deposit the following amounts into your savings account, earning annually compounded interest. How much you will have at the end of the year?

$

$

$

$

If you buy a factory for $ and the terms are percent down, the balance to be paid off over years at a percent rate of interest on the unpaid balance, what are the equal annual payments?

You deposit $ today in an account earing annual interest and keep it for years. In years, you add $ to your account, but the rate on your account changes to annual interest for existing balance and new deposit You leave the account untouched for an additional years. How much do you accumulate?

Two brothers each open IRAs in and plan to invest $ per year for the next years. John makes his first deposit on January and will make all future deposits on the first day of the year. Bill makes his first deposit on December and will continue to make his annual deposits on the last day of each year. At the end of years, How much the difference in the value of the IRAs rounded to the nearest dollar assuming an interest rate of per year, will be

Bill borrowed $ today that he must repay in annual endofyear installments of $ What annual interest rate is Bill paying on his loan?

A financial advisor tells you that you can make your child a millionaire if you just start saving early. You decide to put an equal amount each year into an investment account that earns interest per year, starting on his first birthday. How much would you need to invest each year rounded to the nearest dollar to accumulate a million for your child by the time he is years old?

You have contracted to buy a house for $ paying $ down and taking out a fully amortizing loan for the balance, at a annual rate for years. What will your monthly payment be if they make equal monthly installments over the next years to the nearest dollar

An investment is expected to yield $ in three years, $ in five years, and $ in seven years. What is the present value of this investment if our opportunity rate is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock