Question: homework 22 For this example, calculate (1) the initial cash flow, (2) the operating cash flows, and (3) the terminal cash flow. Using the cost

homework 22

For this example, calculate (1) the initial cash flow, (2) the operating cash flows, and (3) the terminal cash flow. Using the cost of capital (WACC) of 15%, calculate the project's NPV and IRR. Use the NPV and IRR to make a recommendation of whether the machine should be replaced. Be sure to be specific about why you make your recommendation.

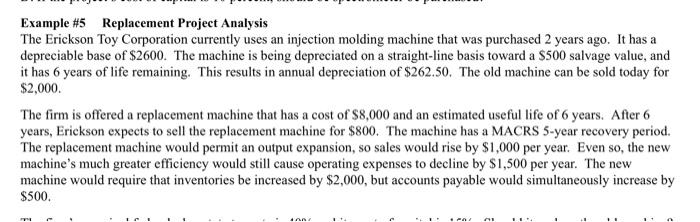

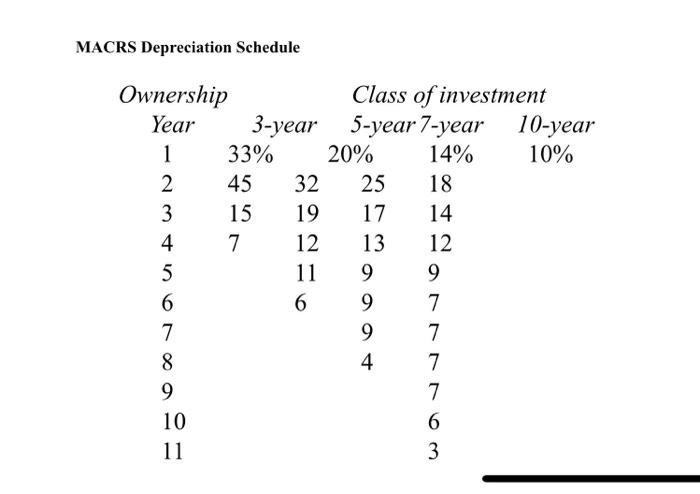

Example #5 Replacement Project Analysis The Erickson Toy Corporation currently uses an injection molding machine that was purchased 2 years ago. It has a depreciable base of $2600. The machine is being depreciated on a straight-line basis toward a $500 salvage value, and it has 6 years of life remaining. This results in annual depreciation of $262.50. The old machine can be sold today for $2,000. The firm is offered a replacement machine that has a cost of $8,000 and an estimated useful life of 6 years. After 6 years, Erickson expects to sell the replacement machine for $800. The machine has a MACRS 5-year recovery period. The replacement machine would permit an output expansion, so sales would rise by $1,000 per year. Even so, the new machine's much greater efficiency would still cause operating expenses to decline by $1,500 per year. The new machine would require that inventories be increased by $2,000, but accounts payable would simultaneously increase by $500 . MACRS Depreciation Schedule Ownership Class of investment Year 3-year 5-year 7-year 10-year 1 33% 20% 14% 10% 2 2 45 32 25 18 3 15 19 17 14 4 7 12 13 12 5 11 9 9 6 6 9 7 7 9 7 8 4 7 9 7 10 6 11 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts