Question: Homework # 3 - Retirement Problems 1 - You deposit $ 5 , 0 0 0 per year at the end of each of the

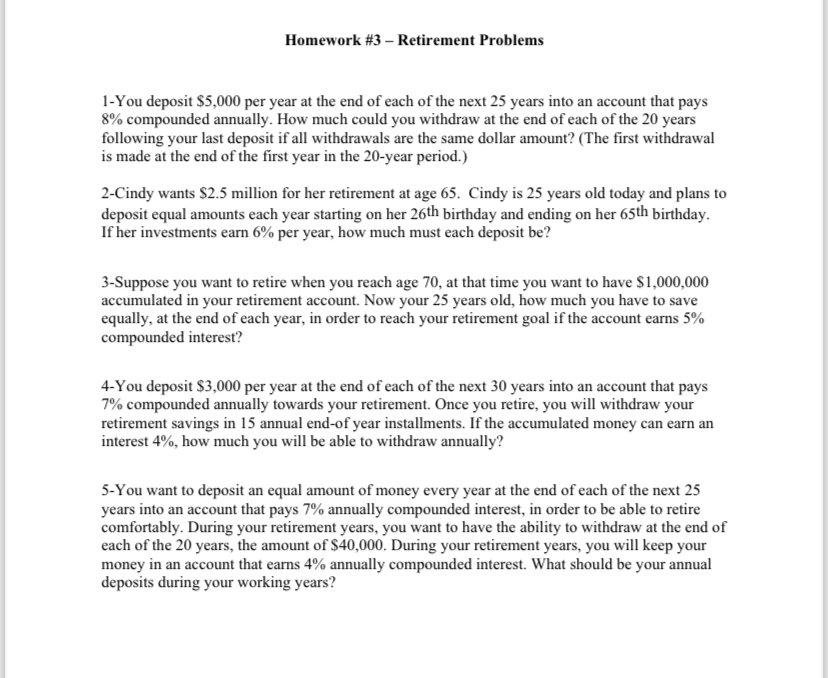

Homework # Retirement Problems

You deposit $ per year at the end of each of the next years into an account that pays compounded annually. How much could you withdraw at the end of each of the years following your last deposit if all withdrawals are the same dollar amount? The first withdrawal is made at the end of the first year in the year period.

Cindy wants $ million for her retirement at age Cindy is years old today and plans to deposit equal amounts each year starting on her birthday and ending on her birthday. If her investments earn per year, how much must each deposit be

Suppose you want to retire when you reach age at that time you want to have $ accumulated in your retirement account. Now your years old, how much you have to save equally, at the end of each year, in order to reach your retirement goal if the account earns compounded interest?

You deposit $ per year at the end of each of the next years into an account that pays compounded annually towards your retirement. Once you retire, you will withdraw your retirement savings in annual endof year installments. If the accumulated money can earn an interest how much you will be able to withdraw annually?

You want to deposit an equal amount of money every year at the end of each of the next years into an account that pays annually compounded interest, in order to be able to retire comfortably. During your retirement years, you want to have the ability to withdraw at the end of each of the years, the amount of $ During your retirement years, you will keep your money in an account that earns annually compounded interest. What should be your annual deposits during your working years?

show steps and formulas

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock