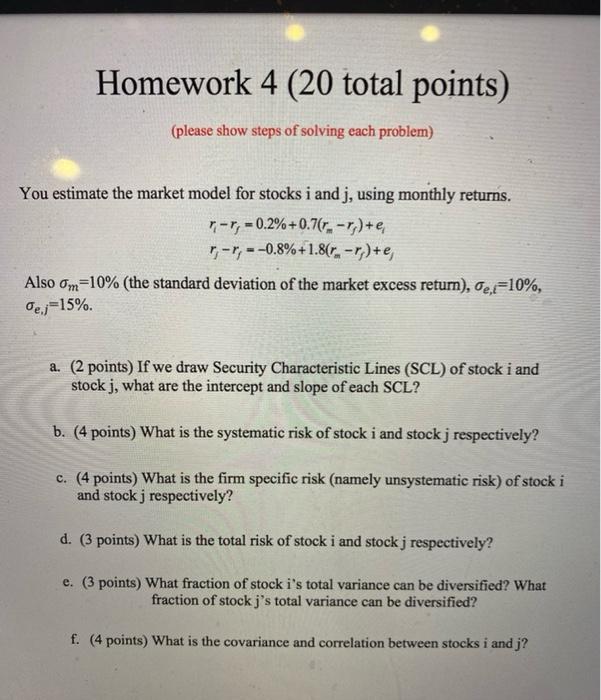

Question: Homework 4 (20 total points) (please show steps of solving each problem) You estimate the market model for stocks i and j, using monthly returns.

Homework 4 (20 total points) (please show steps of solving each problem) You estimate the market model for stocks i and j, using monthly returns. - r;=0.2%+0.76r.- r)+e r;--;=-0.8%+1.8(r-r)+e, Also Om=10% (the standard deviation of the market excess return), 0,2=10%, Pej=15%. a. (2 points) If we draw Security Characteristic Lines (SCL) of stock i and stock j, what are the intercept and slope of each SCL? b. (4 points) What is the systematic risk of stock i and stock j respectively? c. (4 points) What is the firm specific risk (namely unsystematic risk) of stock i and stock j respectively? d. (3 points) What is the total risk of stock i and stock j respectively? e. (3 points) What fraction of stock i's total variance can be diversified? What fraction of stock j's total variance can be diversified? f. (4 points) What is the covariance and correlation between stocks i and j

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts