Question: Homework (45 points) The machine initial cost is $145,000 and it will be used for 3 years. The machine will be depreciated using MACRS 5-year

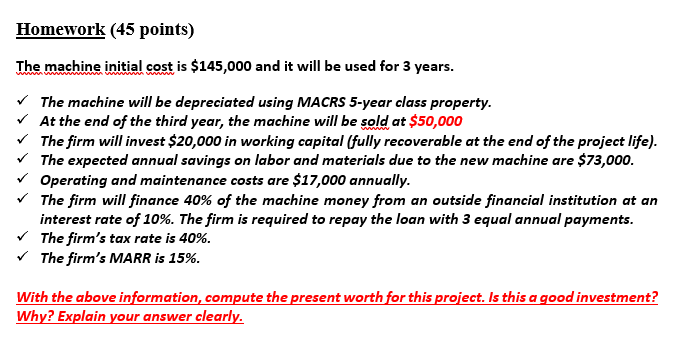

Homework (45 points) The machine initial cost is $145,000 and it will be used for 3 years. The machine will be depreciated using MACRS 5-year class property. At the end of the third year, the machine will be sold at $50,000 The firm will invest $20,000 in working capital (fully recoverable at the end of the project life). The expected annual savings on labor and materials due to the new machine are $73,000. Operating and maintenance costs are $17,000 annually. The firm will finance 40% of the machine money from an outside financial institution at an interest rate of 10%. The firm is required to repay the loan with 3 equal annual payments. The firm's tax rate is 40%. The firm's MARR is 15%. With the above information, compute the present worth for this project. Is this a good investment? Why? Explain your answer clearly. Homework (45 points) The machine initial cost is $145,000 and it will be used for 3 years. The machine will be depreciated using MACRS 5-year class property. At the end of the third year, the machine will be sold at $50,000 The firm will invest $20,000 in working capital (fully recoverable at the end of the project life). The expected annual savings on labor and materials due to the new machine are $73,000. Operating and maintenance costs are $17,000 annually. The firm will finance 40% of the machine money from an outside financial institution at an interest rate of 10%. The firm is required to repay the loan with 3 equal annual payments. The firm's tax rate is 40%. The firm's MARR is 15%. With the above information, compute the present worth for this project. Is this a good investment? Why? Explain your answer clearly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts