Question: Homework 5 ( 1 8 pts ) . Due by 1 1 : 5 9 pm , Sunday, April 1 4 . Problem 1 .

Homework pts Due by :pm Sunday, April

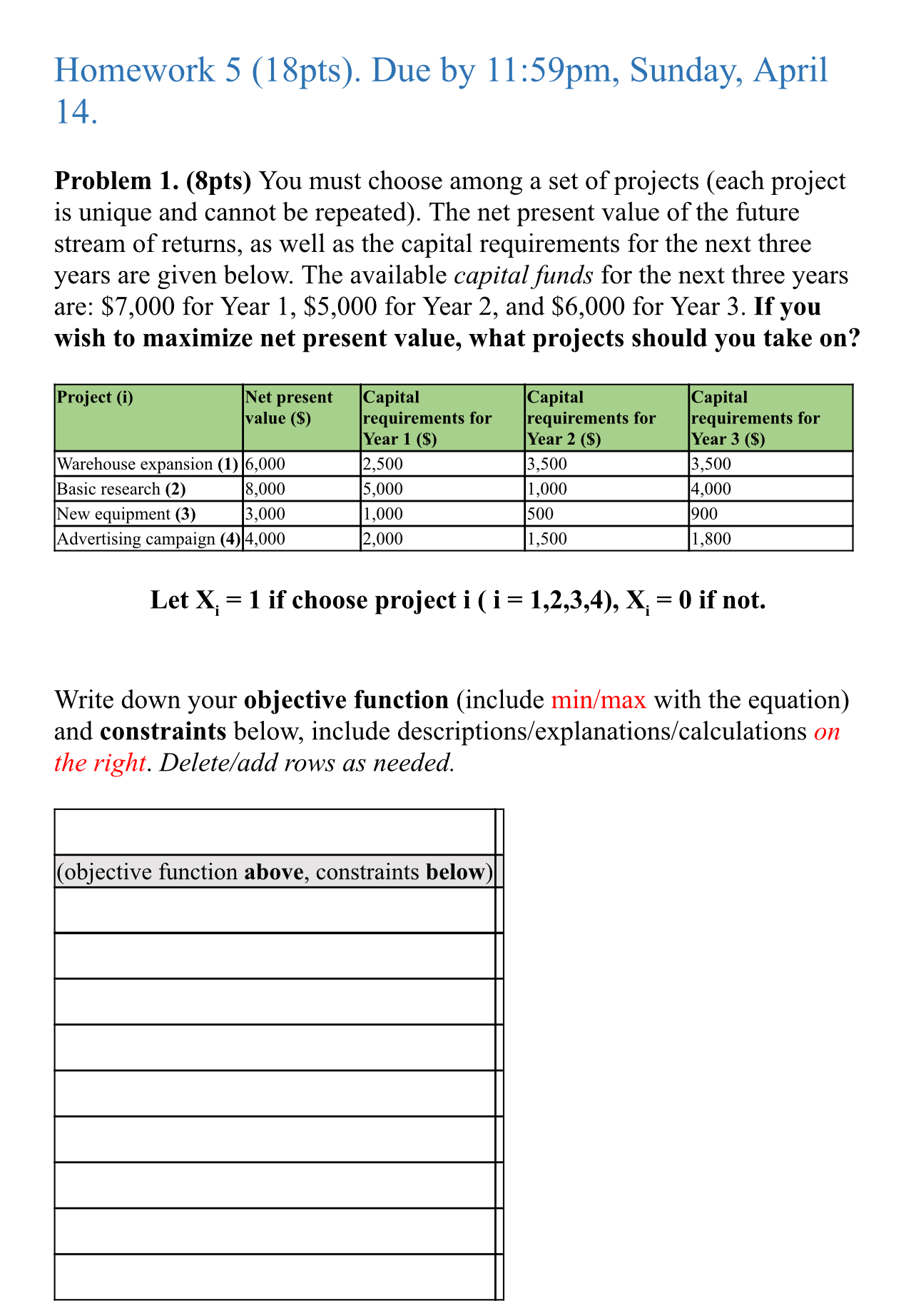

Problem pts You must choose among a set of projects each project is unique and cannot be repeated The net present value of the future stream of returns, as well as the capital requirements for the next three years are given below. The available capital funds for the next three years are: $ for Year $ for Year and $ for Year If you wish to maximize net present value, what projects should you take on

tableProject itableNet presentvalue $tableCapitalrequirements forYear $tableCapitalrequirements forYear $tableCapitalrequirements forYear $Warehouse expansion Basic research New equipment Advertising campaign

Let if choose project if not.

Write down your objective function include with the equation and constraints below, include descriptionsexplanationscalculations on the right. Deleteadd rows as needed.

tableobjective function above, constraints below

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock