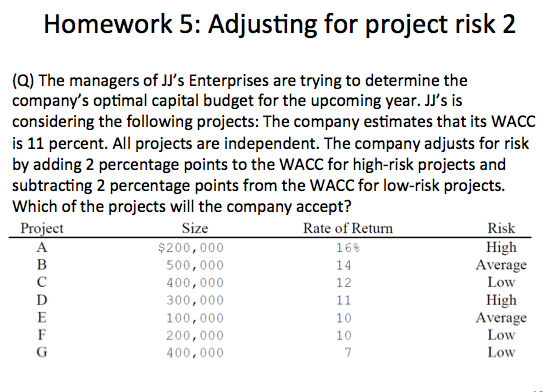

Question: Homework 5: Adjusting for project risk 2 (Q) The managers of JJ's Enterprises are trying to determine the company's optimal capital budget for the upcoming

Homework 5: Adjusting for project risk 2 (Q) The managers of JJ's Enterprises are trying to determine the company's optimal capital budget for the upcoming year. JJ's is considering the following projects: The company estimates that its WACC is 11 percent. All projects are independent. The company adjusts for risk by adding 2 percentage points to the WACC for high-risk projects and subtracting 2 percentage points from the WACC for low-risk projects Which of the projects will the company accept? Risk High Average Low High Average Low Low Rate of Return 168 14 12 Project Size $200,000 500,000 400,000 300,000 100,000 200,000 400,000 10 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts