Question: = Homework: 5-1 MyLab Homework Question 3, Problem 6-14 (algorithmic) Part 1 of 3 > HW Score: 15%, 4.8 of 32 points O Points: 0

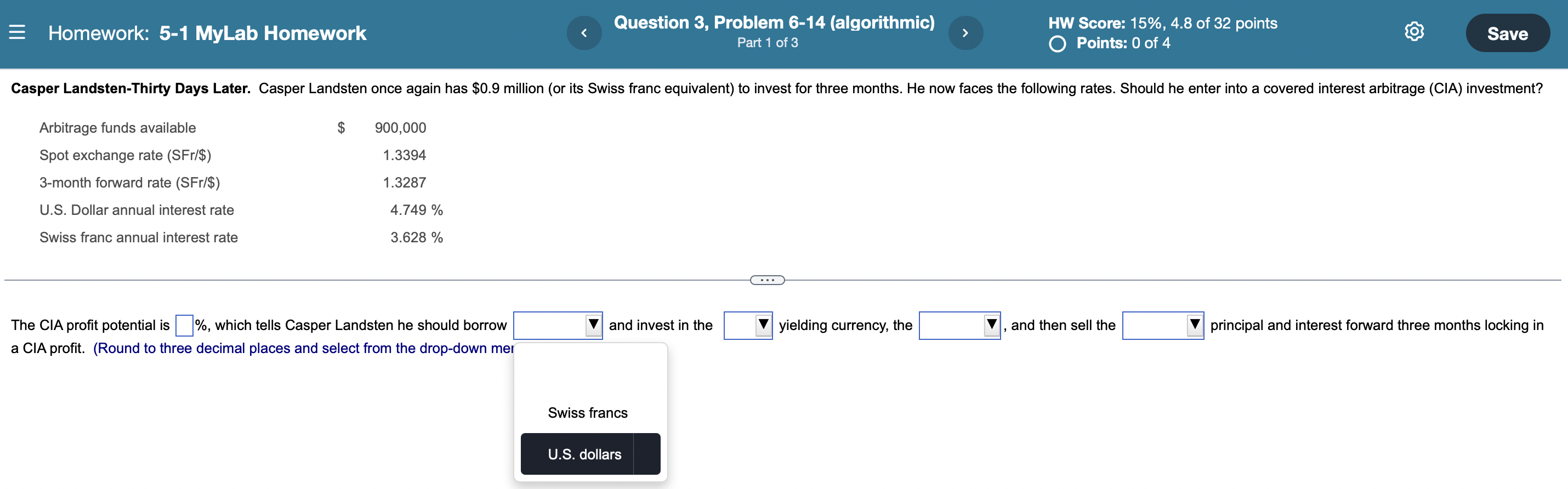

= Homework: 5-1 MyLab Homework Question 3, Problem 6-14 (algorithmic) Part 1 of 3 > HW Score: 15%, 4.8 of 32 points O Points: 0 of 4 Save Casper Landsten-Thirty Days Later. Casper Landsten once again has $0.9 million (or its Swiss franc equivalent) to invest for three months. He now faces the following rates. Should he enter into a covered interest arbitrage (CIA) investment? Arbitrage funds available $ 900,000 1.3394 Spot exchange rate (SFr/$) 3-month forward rate (SFr/$) 1.3287 U.S. Dollar annual interest rate 4.749 % Swiss franc annual interest rate 3.628 % and invest in the yielding currency, the and then sell the principal and interest forward three months locking in The CIA profit potential is %, which tells Casper Landsten he should borrow a CIA profit. (Round to three decimal places and select from the drop-down mer Swiss francs U.S. dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts