Question: Homework 6 Saved Help Save & Exit Submit Check my work 12 An asset was purchased three years ago for $150,000. It falls into the

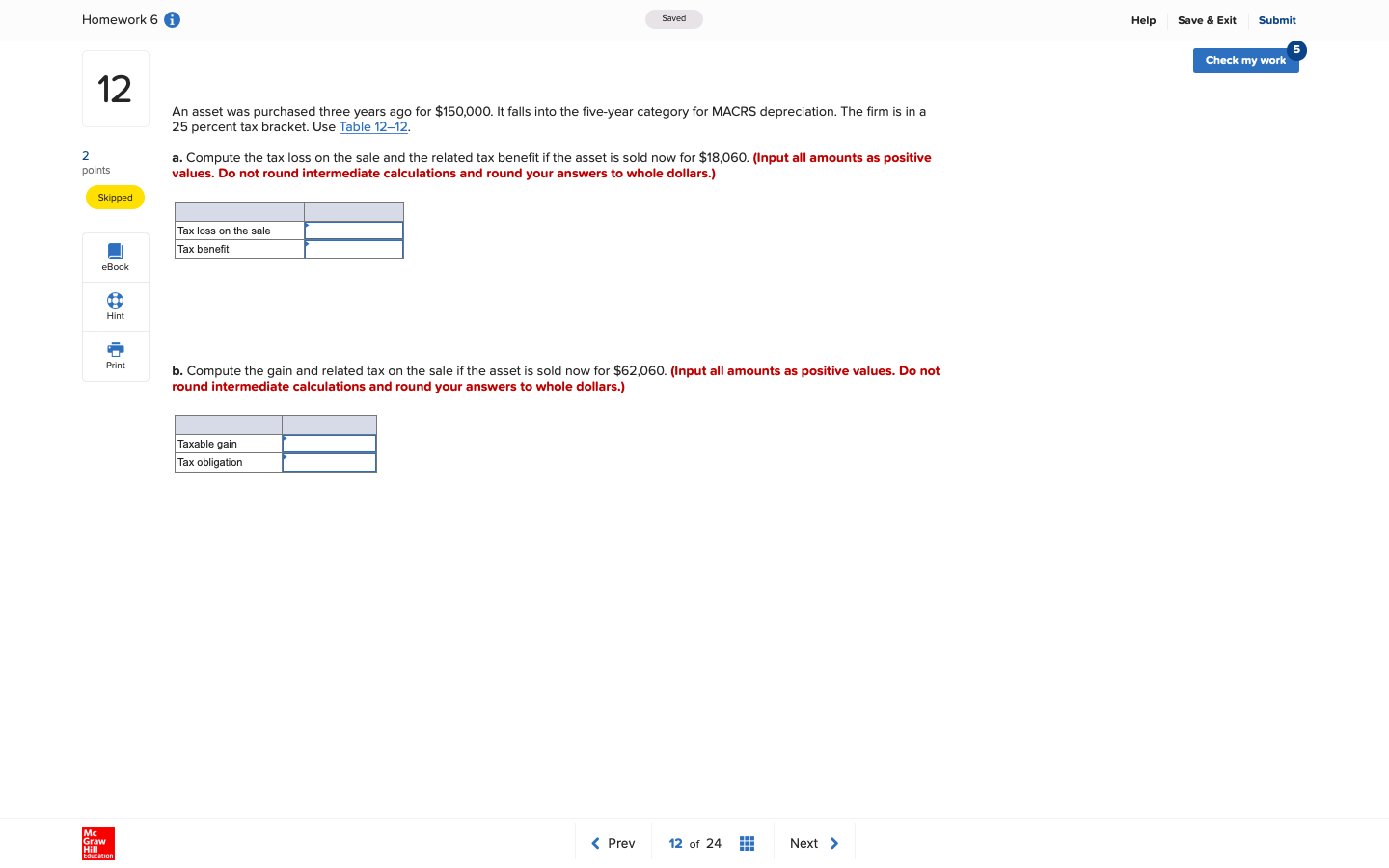

Homework 6 Saved Help Save & Exit Submit Check my work 12 An asset was purchased three years ago for $150,000. It falls into the five-year category for MACRS depreciation. The firm is in a 25 percent tax bracket. Use Table 12-12. 2 points a. Compute the tax loss on the sale and the related tax benefit if the asset is sold now for $18,060. (Input all amounts as positive values. Do not round intermediate calculations and round your answers to whole dollars.) Skipped Tax loss on the sale Tax benefit eBook Git Hint Print b. Compute the gain and related tax on the sale if the asset is sold now for $62,060. (Input all amounts as positive values. Do not round intermediate calculations and round your answers to whole dollars.) Taxable gain Tax obligation Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts