Question: Homework: 6-3 MyFinanceLab: Assignment: Module Six Homewd Save Score: 0 of 7 pts 3 of 7 (5 complete) HW Score: 56%, 28 of 50 pts

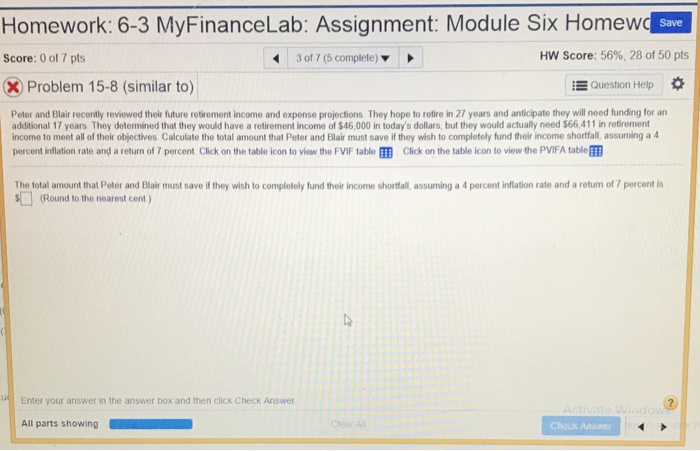

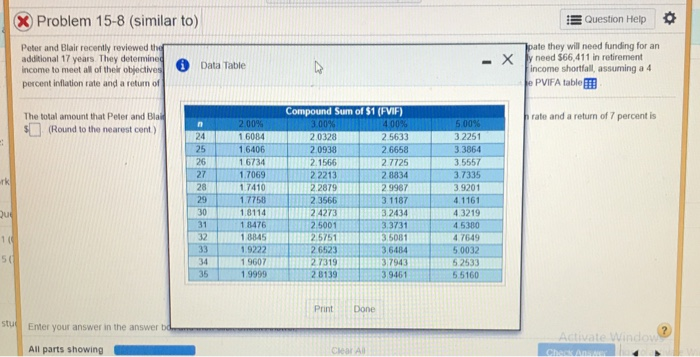

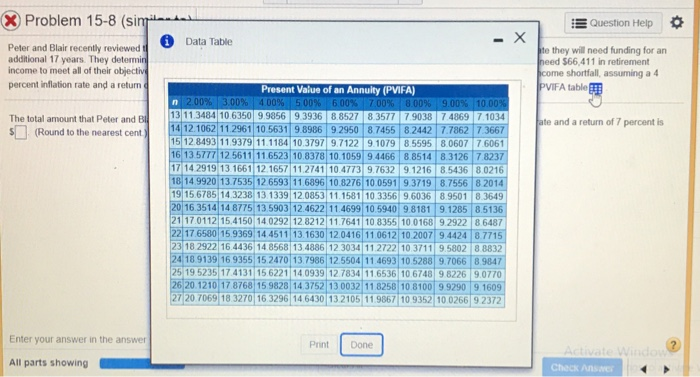

Homework: 6-3 MyFinanceLab: Assignment: Module Six Homewd Save Score: 0 of 7 pts 3 of 7 (5 complete) HW Score: 56%, 28 of 50 pts X Problem 15-8 (similar to) EQuestion Help Peter and Blair recenily reviewed their future retirement income and expense projections. They hope to retire in 27 years and anticipate they will need funding for an additional 17 years They determined that they would have a retirement income of $46,000 in today's dollars, but they would actually need $66.411 in retirement income to meet all of their objectives Calculate the total amount that Peter and Blair must save if they wish to completely fund their income shortfall, assuming a 4 percent inflation rate and a return of 7 percent Click on the table icon to viesw the FVIF table BEB Click on the table icon to view the PVIFA table EEB The total amount that Peter and Blair must save if they wish to completely fund their income shortfall, assuning a 4 percent inflation rate and a retun of 7 percent i (Round to the nearest cent) u Enter your answer in the answer box and then click Check Answer All parts showing Check Answe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts