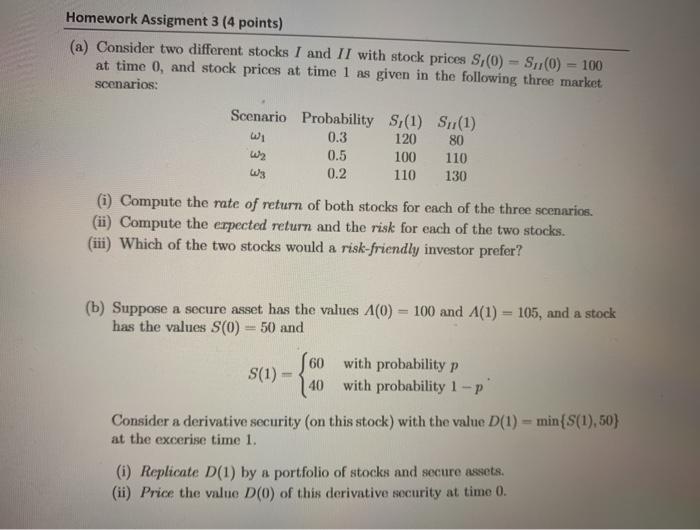

Question: Homework Assigment 3 (4 points) (a) Consider two different stocks I and II with stock prices S,(0) -S(O) = 100 at time 0, and stock

Homework Assigment 3 (4 points) (a) Consider two different stocks I and II with stock prices S,(0) -S(O) = 100 at time 0, and stock prices at time 1 as given in the following three market scenarios: Scenario Probability S(1) S(1) 0.3 120 80 0.5 100 110 W3 0.2 110 130 (i) Compute the rate of return of both stocks for each of the three scenarios. (ii) Compute the expected return and the risk for each of the two stocks. (iii) Which of the two stocks would a risk-friendly investor prefer? (b) Suppose a secure asset has the values A(0) = 100 and A(1) = 105, and a stock has the values S(0) = 50 and 60 with probability p S(1) - 40 with probability 1 - P Consider a derivative security (on this stock) with the value D(1) = min{S(1),50) at the excerise time 1. (i) Replicate D(1) by a portfolio of stocks and secure assets. (ii) Price the value D(0) of this derivative security at time 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts