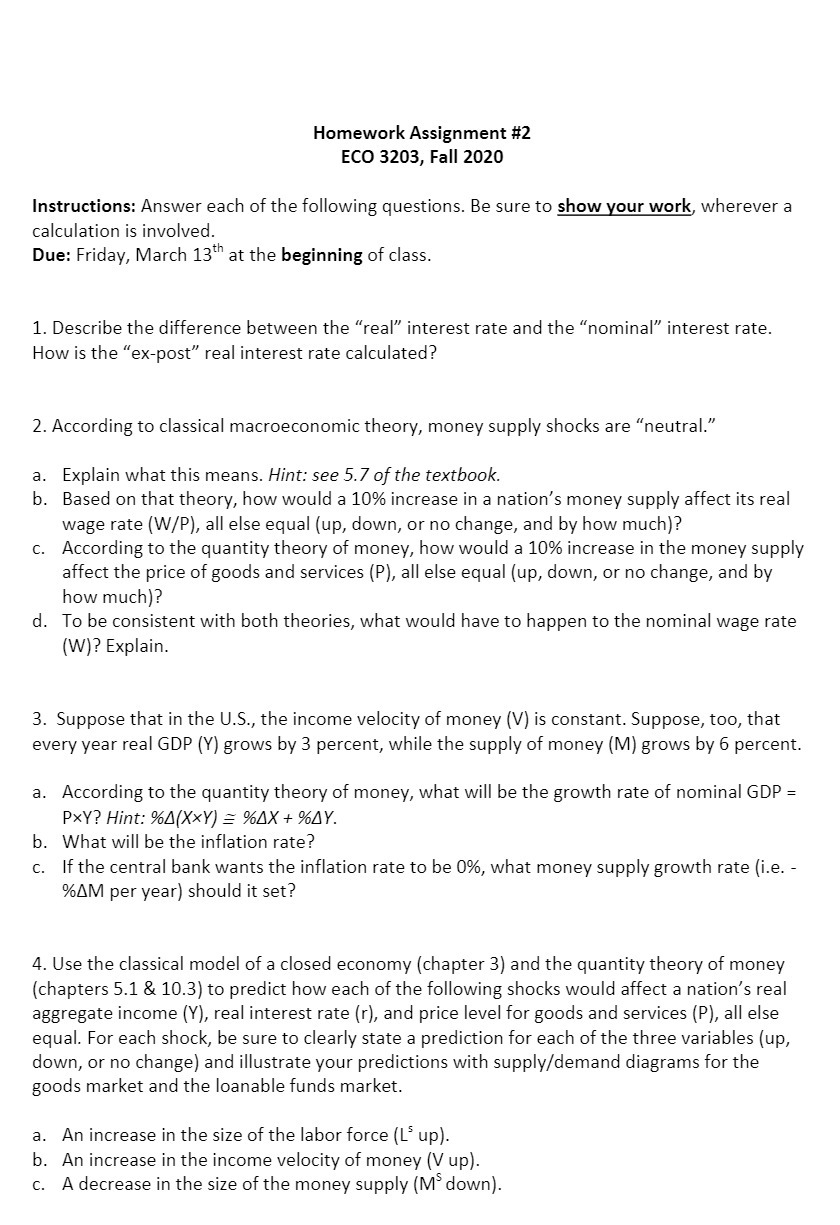

Question: Homework Assignment #2 ECU 3203, Fall 2020 Instructions: Answer each of the following questions. Be sure to show your work. wherever a calculation is involved.

Homework Assignment #2 ECU 3203, Fall 2020 Instructions: Answer each of the following questions. Be sure to show your work. wherever a calculation is involved. Due: Friday, March 13th at the beginning of class. 1. Describe the difference between the "real" interest rate and the "nominal\" interest rate. How is the "expost" real interest rate calculated? 2. According to classical macroeconomic theory, money supply shocks are "neutral.\" a. Explain what this means. Hint: see 5.? ofthe textbook. b. Based on that theory, how would a 10% increase in a nation's money supply affect its real wage rate [WIP], all else equal (up, down, or no change, and by how much)? c. According to the quantity theory of money, how would a 10% increase in the money supply affect the price of goods and services (P), all else equal (up, down, or no change, and by how much]? d. To be consistent with both theories, what would have to happen to the nominal wage rate (W)? Explain. 3. Suppose that in the U.S., the income velocity of money [V] is constant. Suppose, too, that every year real GDP {Y} grows by 3 percent, while the supply of money (M) grows by 6 percent. a. According to the quantity theory of money, what will be the growth rate of nominal GDP = M? Hint: imam 5 95.11): + my. b. What will be the inflation rate? c. If the central bank wants the inflation rate to be 0%, what money supply growth rate [i.e. 96AM per year) should it set? 4. Use the classical model of a closed economy {chapter 3] and the quantity theory of money (chapters 5.1 81 10.3} to predict how each of the following shocks would affect a nation's real aggregate income ff), real interest rate (r), and price level for goods and services [P], all else equal. For each shock, be sure to clearly state a prediction for each of the three variables (up, down, or no change] and illustrate your predictions with supplyfdemand diagrams for the goods market and the loanable funds market. a. An increase in the size of the labor force (L5 up}. b. An increase in the income velocity of money [V up). c. A decrease in the size of the money supply [Msdownl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts