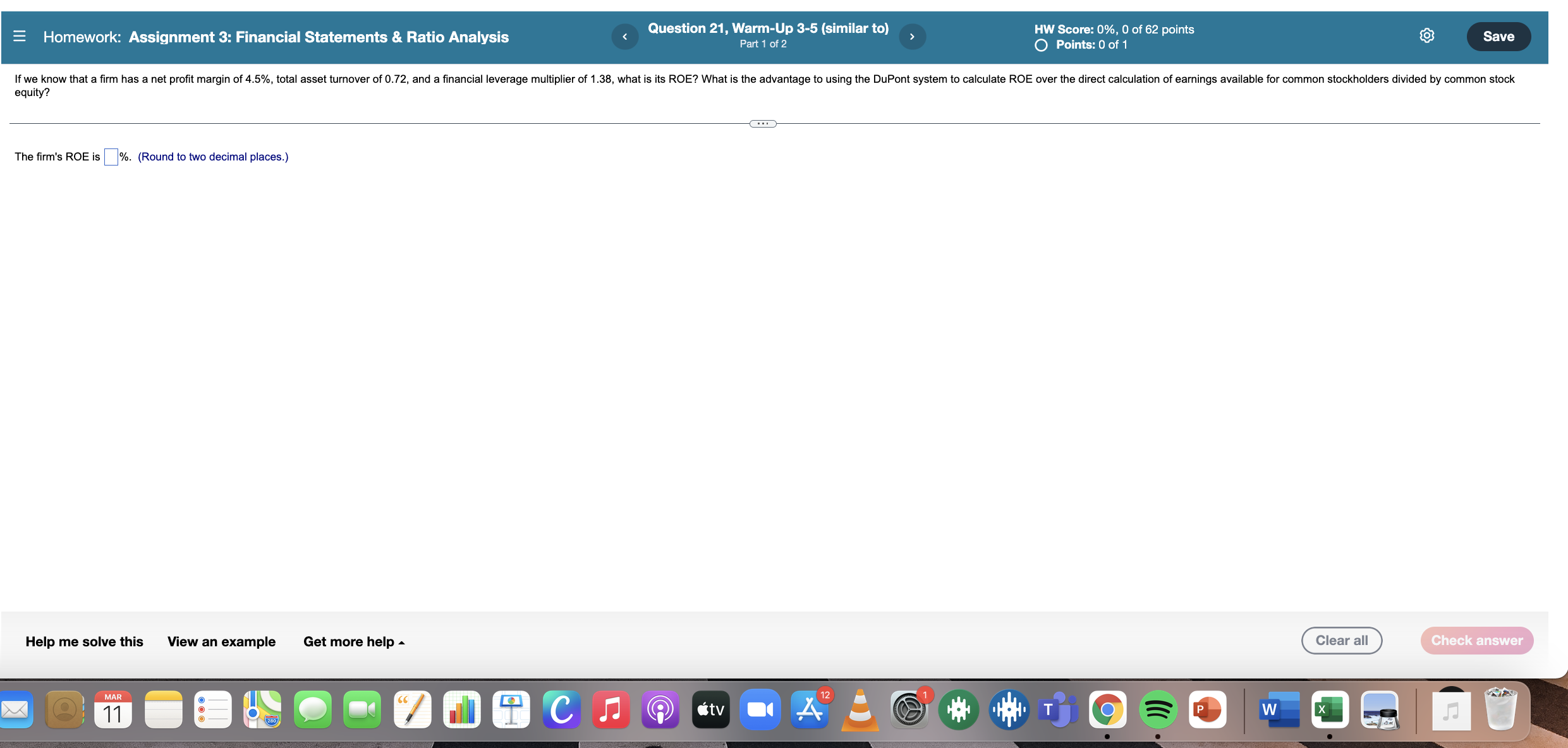

Question: Homework: Assignment 3: Financial Statements & Ratio Analysis Question 21, Warm-Up 3-5 (similar to) HW Score: 0%, 0 of 62 points Save Part 1 of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts